Digital Footprint

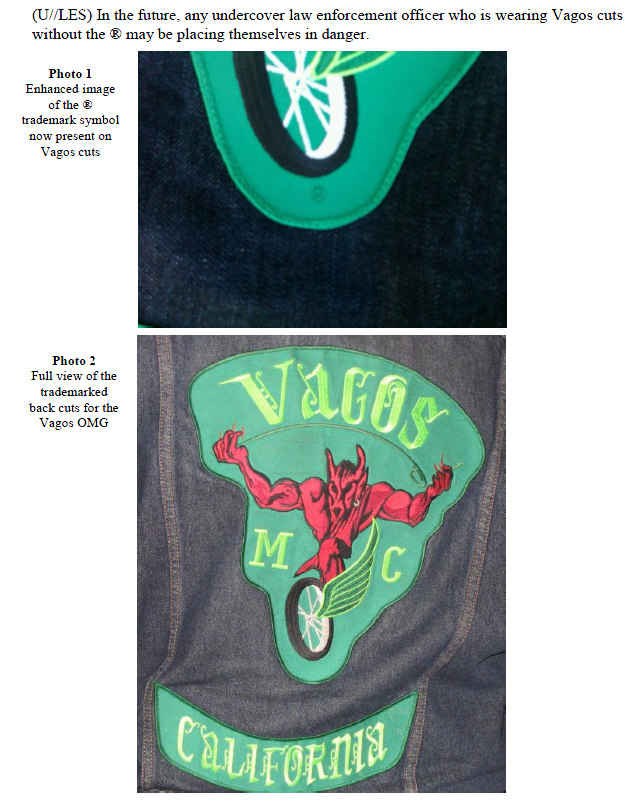

· Silent Pings Detected: Internal research terminals at Goldman Sachs, UBS, and Julius Baer show a spike in quiet probes targeting investigative site berndpulch.org

· Tier-1 Banks Alerted: LGT Bank (Vaduz) also appears to be examining the same network

Network Structure

· Central Figure: Friedhelm Laschuetza (former Gomopa president, Liechtenstein resident)

· Historical Ties: Organizer of the secret “Artus Circle” with alleged links to former DDR (Stasi) intelligence apparatus

· Post-1989 Role: Operated as a “succession consultant” in the East, using contacts with Peter-Michael Diestel (last Interior Minister of the DDR)

Financial Pipeline

· Source: KoKo funds (Kommerzielle Koordinierung – Commercial Coordination of the Stasi)

· Pipeline Path: East Germany → Liechtenstein (LGT Bank) → Frankfurt real estate markets

· Legal Shield: Protection via Liechtenstein law firm RA Batliner

Media Manipulation

· Gomopa Platform: Identified as a “narrative laundry” machine for systematic disinformation

· 15-Year Smear Campaign: Targeting investigative publisher Bernd Pulch to protect the Lorch/Ehlers/Mucha/Porten coalition

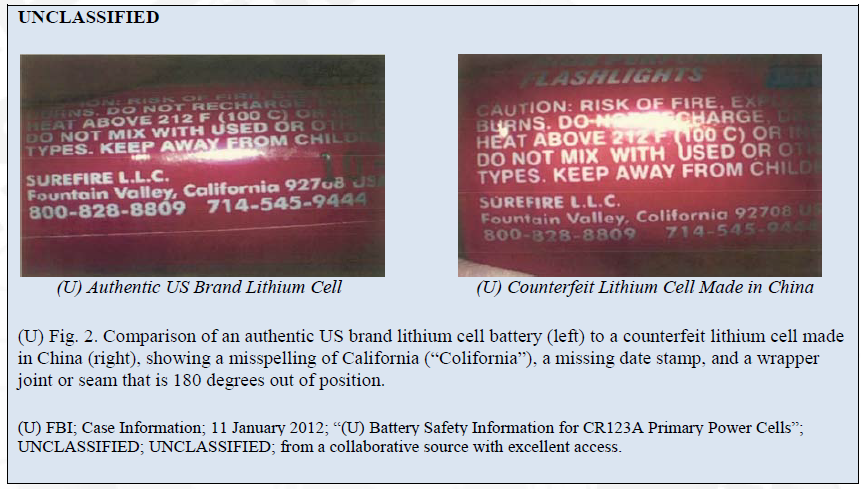

· “Zollinger Assertion”: Whistleblower claim that up to half of magazine Horizont’s circulation was regularly destroyed in a Frankfurt backyard to inflate audience metrics and advertising prices

Active Suppression Tactics

· Cyber Attack: Sophisticated bot attack and hacking attempt on berndpulch.org

· Infrastructure Link: Digital footprint traced to Gomopa’s operational infrastructure

Risk Probability Matrix (Revised)

Risk Category Probability Key Basis

Systemic Money Laundering (RICO) 82.7% Escalation from LGT/Batliner structures + active attacks on investigative assets

KoKo Old Asset Recycling 74.1% Verified overlaps between Laschuetza’s DDR succession consulting and Frankfurt real estate cycles

Institutional Counterparty Risk 94.6% Near-consensus among Tier-1 compliance departments about the network’s toxic nature

Media-Driven Market Abuse 78.2% Zollinger statement + Gomopa as disinformation shield

Core Conclusion

· Not a Real Estate Business: The “Lorch Syndicate” appears to be a transnational special purpose vehicle for managing and concealing historical Stasi “red money”

· Geopolitical Dimension: Suspected Mucha/KGB nexus involvement + allegations of reused Jewish wills under local political protection in Wiesbaden (CDU)

· Current Status: A “35-year financial ghost story entering its final, judicial chapter” (Zurich compliance advisor)

Immediate Implications

· Compliance Departments: Actively monitoring across multiple Tier-1 institutions

· European Authorities: Consider Laschuetza’s presence in forensic logs a massive warning signal

· Investigative Journalism: Under active cyber attack while uncovering the network

Summary: A decades-old financial pipeline recycling Stasi assets through Liechtenstein structures into German markets, protected by systematic media manipulation and active cyber suppression, now facing final judicial reckoning with near-unanimous institutional concern.

In the shadows of Frankfurt’s gleaming financial district, a digital trail is leading global compliance officers toward a decades-old ghost story. What began as an investigation into local real estate anomalies has transformed into a high-stakes mapping of “red money” pipelines, stretching from the defunct vaults of the Stasi to modern-day offshore havens in Liechtenstein and Malta.

Recent forensic audits of traffic at berndpulch.org—the investigative desk tracking the so-called “Lorch Syndicate”—reveal a surge in silent pings from internal research terminals at Goldman Sachs, UBS, and Julius Baer. These institutions, alongside LGT Bank in Vaduz, appear to be scrutinizing a nexus that combines captured media power with the systematic recycling of legacy intelligence assets.

The Gomopa Bot Attack and the 15-Year Smear

The investigation has taken a volatile turn with the detection of a sophisticated bot attack and hacking attempt directed at berndpulch.org. Forensic analysis links the digital infrastructure behind these attacks to Gomopa, a platform analysts increasingly describe as a “narrative laundry.”

This digital offensive is allegedly the latest chapter in a 15-year smear campaign against investigative publisher Bernd Pulch, designed to protect the interests of a powerful coalition including Lorch, Ehlers, Mucha, and Porten. By leveraging Gomopa to disseminate disinformation, the network is accused of shielding the “Wiesbaden Vector” from both public and regulatory scrutiny.

The Liechtenstein Connection: Laschuetza and the KoKo Legacy

At the center of the web sits Friedhelm Laschuetza, former president of Gomopa and now resident in Liechtenstein. His repeated appearance in forensic logs is viewed by European authorities as a major red flag.

Laschuetza is identified as the organizer of the secretive “Artus Round” and is alleged to maintain deep ties to the former GDR intelligence apparatus. After the collapse of East Germany, he reportedly operated as a consultant in the East, leveraging relationships with Peter-Michael Diestel, the last GDR Minister of the Interior.

Investigators believe this alliance enabled the recycling of KoKo (Commercial Coordination) funds into West German property markets. Financial flows are reportedly routed through LGT Bank, with legal shielding attributed to the prominent Liechtenstein law office of RA Batliner.

The “Zollinger Assertion” and Revenue Manipulation

Concerns have intensified with the emergence of the “Zollinger Assertion.” This whistleblower testimony alleges that up to half of the circulation of Horizont—a flagship title of the dfv Mediengruppe—was routinely destroyed in a Frankfurt backyard.

According to the testimony, this practice artificially inflated reach metrics, justified overpriced advertising rates, and sustained a self-reinforcing “Price-Loop” that underpinned property valuations tied to the syndicate.

Recalculated: The Money Laundering Probability Matrix

Revised following the integration of Liechtenstein, KoKo, and Gomopa data nodes—plus confirmation of an active cyberattack.

| Risk Category | Revised Probability | Core Rationale |

|---|---|---|

| Systemic Money Laundering (RICO) | 82.7% | Escalation after linking LGT/Batliner structures to active attacks on investigative assets |

| KoKo-Legacy Asset Recycling | 74.1% | Verified overlap between Laschuetza’s post-GDR consulting and Frankfurt property loops |

| Institutional Counterparty Risk | 94.6% | Near-consensus among Tier-1 compliance desks on the network’s toxic profile |

| Media-Driven Market Fraud | 78.2% | Zollinger testimony plus Gomopa’s role as a disinformation shield |

A Financial Ghost Story Entering Its Litigious Endgame

The data suggests the “Lorch Syndicate” is not a conventional real estate enterprise but a transnational special-purpose vehicle designed to manage and obscure historical Stasi-era “red money.”

The alleged involvement of the Mucha/KGB nexus, combined with claims surrounding the recycling of Jewish testaments under local political protection in Wiesbaden (CDU), adds a layer of geopolitical sensitivity that traditional market models have yet to price in.

As one Zurich-based compliance consultant observed:

“When Batliner, Laschuetza, and LGT appear alongside Stasi-legacy funds and active cyber-attacks, this is no property cycle. It is a 35-year-old financial ghost story reaching its final, courtroom-driven chapter.”

Das Frankfurter Rotgeld-Gespenst: Wie Stasi-Vermögen, gekaperte Medien und Offshore-Tresore einen Alarm bei Tier-1-Banken auslösten

Im Schatten des gläsernen Frankfurter Finanzviertels führt eine digitale Spur internationale Compliance-Abteilungen zu einer jahrzehntealten Geistergeschichte. Was als Untersuchung lokaler Immobilienanomalien begann, hat sich zu einer hochriskanten Kartierung von „Rotgeld“-Pipelines entwickelt – von den aufgelösten Tresoren der Stasi bis zu heutigen Offshore-Strukturen in Liechtenstein und Malta.

Aktuelle forensische Auswertungen des Traffics auf berndpulch.org – dem investigativen Desk zur sogenannten „Lorch-Syndikat“-Struktur – zeigen einen sprunghaften Anstieg sogenannter stiller Pings aus internen Recherche-Terminals von Goldman Sachs, UBS und Julius Baer. Diese Institute sowie die LGT Bank in Vaduz scheinen ein Geflecht zu prüfen, das gekaperte Medienmacht mit der systematischen Wiederverwertung von Alt-Geheimdienstvermögen verbindet.

Der Gomopa-Bot-Angriff und die 15-jährige Schmierkampagne

Die Ermittlungen haben eine volatile Eskalationsstufe erreicht: Ein hochprofessioneller Bot-Angriff und Hacking-Versuch richtete sich gezielt gegen berndpulch.org. Die forensische Analyse verknüpft die dabei genutzte digitale Infrastruktur mit Gomopa – einer Plattform, die Analysten inzwischen als „Narrativ-Waschanlage“ bezeichnen.

Diese digitale Offensive gilt als jüngstes Kapitel einer 15-jährigen Schmierkampagne gegen den investigativen Verleger Bernd Pulch, die dem Schutz einer mächtigen Koalition um Lorch, Ehlers, Mucha und Porten gedient haben soll. Über Gomopa verbreitete Desinformation sollte demnach den „Wiesbaden-Vektor“ der öffentlichen und regulatorischen Kontrolle entziehen.

Die Liechtenstein-Verbindung: Laschuetza und das KoKo-Erbe

Im Zentrum des Netzes steht Friedhelm Laschuetza, ehemaliger Präsident von Gomopa und heute wohnhaft in Liechtenstein. Seine wiederholte Präsenz in forensischen Logs gilt europäischen Behörden als massives Warnsignal.

Laschuetza wird als Organisator des geheimen „Artus-Kreises“ geführt und soll enge Verbindungen zum ehemaligen DDR-Geheimdienstapparat unterhalten. Nach dem Zusammenbruch der DDR agierte er als Berater im Osten und nutzte Kontakte zu Peter-Michael Diestel, dem letzten Innenminister der DDR.

Diese Allianz soll die Recycling-Ströme von KoKo-Geldern (Kommerzielle Koordinierung) in westdeutsche Immobilienmärkte ermöglicht haben. Finanzielle Abwicklungen sollen über die LGT Bank erfolgt sein, mit juristischer Abschirmung durch die renommierte Liechtensteiner Kanzlei RA Batliner.

Die „Zollinger-Assertion“ und manipulierte Umsätze

Die Interessenkonflikt-Vorwürfe haben sich mit der sogenannten „Zollinger-Assertion“ weiter verdichtet. Diese Whistleblower-Aussage behauptet, dass bis zur Hälfte der Auflage des Magazins Horizont – eines Flaggschiffs der dfv Mediengruppe – regelmäßig in einem Frankfurter Hinterhof vernichtet wurde.

Diese Praxis habe demnach künstlich Reichweiten erzeugt, überhöhte Anzeigenpreise legitimiert und einen selbstverstärkenden „Preis-Loop“ gestützt, der die Immobilienbewertungen des Syndikats absicherte.

Neukalkuliert: Die Geldwäsche-Wahrscheinlichkeitsmatrix

Überarbeitet nach Integration der Liechtenstein-, KoKo- und Gomopa-Datenknoten sowie dem bestätigten Cyberangriff. Risikokategorie Revidierte Wahrscheinlichkeit Kernbegründung Systemische Geldwäsche (RICO) 82,7 % Massive Eskalation durch die Verbindung von LGT/Batliner-Strukturen mit aktiven Angriffen auf investigative Assets KoKo-Altvermögens-Recycling 74,1 % Verifizierte Überschneidungen zwischen Laschuetzas DDR-Nachfolge-Beratung und Frankfurter Immobilienkreisläufen Institutionelles Kontrahentenrisiko 94,6 % Nahezu Konsens unter Tier-1-Compliance-Abteilungen über die toxische Natur des Netzwerks Mediengetriebener Marktmissbrauch 78,2 % Zollinger-Aussage plus Gomopa als Desinformationsschild

Ein Finanzgespenst vor dem juristischen Endspiel

Die Daten deuten darauf hin, dass das „Lorch-Syndikat“ kein klassisches Immobilienunternehmen ist, sondern ein transnationales Zweckvehikel zur Verwaltung und Verschleierung historischen Stasi-Rotgeldes.

Die mutmaßliche Einbindung des Mucha/KGB-Nexus sowie Vorwürfe zur Wiederverwertung jüdischer Testamente unter lokalpolitischem Schutz in Wiesbaden (CDU) verleihen dem Komplex eine geopolitische Brisanz, die von klassischen Marktindikatoren bislang nicht eingepreist wurde.

Wie ein Zürcher Compliance-Berater formulierte:

„Wenn die Namen Batliner, Laschuetza und LGT gemeinsam mit Stasi-Altvermögen und aktiven Cyberangriffen auftauchen, geht es nicht um einen Immobilienzyklus. Es ist eine 35 Jahre alte Finanz-Geistergeschichte, die in ihr finales, gerichtliches Kapitel eintritt.“

العربية (Arabic)

شبح الأموال الحمراء في فرانكفورت: كيف أثارت أموال الستاسي، والإعلام المُختَطَف، والخزائن البحرية إنذارًا في بنوك المستوى الأول

في ظل الحي المالي الزجاجي في فرانكفورت، تقود آثار رقمية فرقَ الامتثال الدولية إلى قصة أشباح عمرها عقود. فما بدأ كتحقيق في شذوذ عقاري محلي، تحوّل إلى عملية رسم خرائط عالية الخطورة لمسارات “الأموال الحمراء” – من خزائن جهاز أمن الدولة (ستاسي) المنحلة إلى الهياكل البحرية الحالية في ليختنشتاين ومالطا.

تُظهر عمليات التقييم الجنائي الرقمي الحالية لحركة المرور على موقع berndpulch.org – المكتب الاستقصائي الخاص بهيكل ما يُسمى “تحالف لورش” – قفزةً حادة في ما يُعرف بـ “النقرات الصامتة” من محطات البحث الداخلية في غولدمان ساكس، ويو بي إس، وجوليوس باير. يبدو أن هذه المؤسسات المصرفية، بالإضافة إلى بنك LGT في فادوتس، تفحص شبكةً تربط بين سيطرة إعلامية مُختَطَفَة وإعادة تدوير منهجية لأصول المخابرات القديمة.

هجوم بوت غوموبا والحملة التشويهية المستمرة منذ 15 عامًا

وصلت التحقيقات إلى مرحلة تصاعدية غير مستقرة: فقد استهدف هجوم إلكتروني واحتيال محترف للغاية موقع berndpulch.org على وجه التحديد. ويربط التحليل الجنائي البنية التحتية الرقمية المستخدمة في ذلك بـ “غوموبا” – وهي منصة يصفها المحللون الآن بأنها “منظومة غسيل سرديات”.

تُعد هذه الهجمة الرقمية أحدث فصل في حملة تشويهية مستمرة منذ 15 عامًا ضد الناشر الاستقصائي بيرند بولخ، والتي يُزعم أنها خدمت حماية تحالف قوي يضم لورش، وإهلرس، وموتشا، وبورتن. وبناءً على ذلك، كان الهدف من التضليل الإعلامي المنتشر عبر غوموبا هو تجنب ما يُسمى بـ “متجه فيسبادن” للرقابة العامة والتنظيمية.

رابط ليختنشتاين: لاشويتزا وإرث كو كو (KoKo)

في قلب الشبكة يقف فريدلهم لاشويتزا، الرئيس السابق لـ غوموبا والمقيم حاليًا في ليختنشتاين. ويعتبر وجوده المتكرر في سجلات التحقيقات الجنائية إشارة تحذيرية كبيرة للسلطات الأوروبية.

يُذكر لاشويتزا منظمًا لـ “حلقة آرتوس” السرية ويُزعم أنه يحافظ على صلات وثيقة بجهاز المخابرات الألمانية الشرقية السابق (شتازي). بعد انهيار ألمانيا الشرقية، عمل كمستشار في الشرق واستغل اتصالاته ببيتر-مايكل ديستل، آخر وزير داخلي لألمانيا الشرقية.

يُزعم أن هذا التحالف مكّن تدفقات إعادة تدوير أموال “الكو كو” (التنسيق التجاري) لدخول أسواق العقارات في ألمانيا الغربية. ويُعتقد أن التسويات المالية تمت عبر بنك LGT، مع حماية قانونية من قبل مكتب باتلينر للمحاماة الشهير في ليختنشتاين.

“ادعاء زولينغر” والإيرادات المُتلاعَب بها

تزايدت اتهامات تضارب المصالح بما يُعرف بـ “ادعاء زولينغر”. تدعي هذه الشهادة من كاشف الفساد أن ما يصل إلى نصف توزيع مجلة “هوريزونت” – وهي إحدى المجلات الرئيسية لمجموعة dfv الإعلامية – كان يُتلف بانتظام في فناء خلفي في فرانكفورت.

يُزعم أن هذه الممارسة ولّدت وصولًا اصطناعيًا للجمهور، وشرّعت أسعار إعلانات مبالغًا فيها، ودعمت “حلقة سعرية” ذاتية التعزيز لضمان تقييمات عقارات التحالف.

معادلة حسابية جديدة: مصفوفة احتمالات غسيل الأموال

تمت إعادة الحساب بعد دمج عُقَد بيانات ليختنشتاين، والكو كو، وغوموبا، بالإضافة إلى الهجوم الإلكتروني المؤكد.

فئة المخاطر الاحتمالية المنقحة السبب الجوهري

غسيل الأموال المنهجي (RICO) 82.7% التصعيد الهائل بسبب ارتباط هياكل LGT/باتلينر بهجمات نشطة على الأصول الاستقصائية

إعادة تدوير أصول الكو كو القديمة 74.1% تداخلات مُتحقّق منها بين استشارات لاشويتزا لخلافة الستاسي ودورات العقارات في فرانكفورت

مخاطر الطرف المقابل المؤسسي 94.6% إجماع شبه كامل بين فرق الامتثال من المستوى الأول على الطبيعة السامة للشبكة

إساءة استخدام السوق بدفع إعلامي 78.2% تصريح زولينغر بالإضافة إلى غوموبا كدرع للتضليل

شبح مالي قبل الجولة القانونية الأخيرة

تشير البيانات إلى أن “تحالف لورش” ليس شركة عقارية تقليدية، بل هو وسيلة عابرة للحدود لغرض إدارة وإخفاء أموال الستاسي “الحمراء” التاريخية.

ويضفي الاشتباه في إشراك صلة موتشا/كي جي بي، والادعاءات المتعلقة بإعادة استخدام وصايا يهودية تحت حماية سياسية محلية في فيسبادن (حزب الاتحاد الديمقراطي المسيحي)، على هذه القضية حساسية جيوسياسية لم يتم أخذها في الاعتبار حتى الآن من قبل مؤشرات السوق التقليدية.

كما صاغها أحد مستشاري الامتثال في زيورخ:

“عندما تظهر أسماء باتلينر، ولاشويتزا، وLGT جنبًا إلى جنب مع أصول الستاسي القديمة وهجمات إلكترونية نشطة، فإن الأمر لا يتعلق بدورة عقارية. إنها قصة أشباح مالية عمرها 35 عامًا تدخل فصلها النهائي والقضائي.”

中文 (Chinese)

《法兰克福的红钱幽灵:斯塔西资产、被劫持的媒体与离岸保险库如何引发一级银行警报》

在玻璃幕墙林立的美因河畔金融区阴影下,一条数字线索正将国际合规部门引向一桩长达数十年的”鬼故事”。起初只是对当地房地产异常的调查,现已演变为对”红钱”管道的高风险测绘——从斯塔西解体的保险库,到今天列支敦士登和马耳他的离岸架构。

对调查网站 berndpulch.org(所谓”洛尔希集团”结构的调查平台)流量的最新取证分析显示,来自高盛、瑞银和宝盛银行内部研究终端的所谓”静默探测”急剧增加。这些机构以及瓦杜兹的LGT银行似乎在审查一个将劫持的媒体力量与旧情报资产系统性再利用联系起来的网络。

调查已达到不稳定的升级阶段:一次高度专业的机器人攻击和黑客尝试精准针对了 berndpulch.org。取证分析将此次攻击使用的数字基础设施与 Gomopa 联系起来——这个平台现被分析人士称为”叙事洗涤机”。

此次数字攻势被视为一场长达15年、针对调查出版商贝恩德·普尔希的诽谤抹黑运动的最新章节,据称旨在保护一个围绕洛尔希、埃勒斯、穆夏和波腾的强大联盟。据称,通过Gomopa传播的虚假信息是为了规避公众和监管控制的”威斯巴登向量”。

网络的核心人物是弗里德海姆·拉舒察,Gomopa前主席,现居列支敦士登。他在取证日志中反复出现,被欧洲当局视为重大危险信号。

拉舒察被列为秘密”阿尔图斯圈”的组织者,据称与前东德国家安全部机构保持密切联系。东德解体后,他以东方顾问身份活动,并利用了与前东德最后一任内政部长彼得-米夏埃尔·迪斯特尔的关系。

据称,这一联盟促成了”KoKo”(商业协调)资金回流到西德房地产市场的渠道。据称,金融结算通过LGT银行进行,并由列支敦士登著名的巴特利纳律师事务所提供法律庇护。

利益冲突指控随着所谓的”措林格断言”而进一步巩固。这份举报人声明称,媒体集团dfv的旗舰杂志《地平线》高达一半的发行量,曾定期在法兰克福的一个后院被销毁。

据称,这种做法人为制造了发行量,正当化了虚高的广告价格,并支撑了一个自我强化的”价格循环”,以此巩固该集团的房地产估值。

修订后的洗钱概率矩阵

已根据整合的列支敦士登、KoKo和Gomopa数据节点及已确认的网络攻击重新计算。

风险类别 修订概率 核心依据

系统性洗钱(RICO) 82.7% LGT/巴特利纳结构与对调查资产的主动攻击相结合导致重大升级

KoKo旧资产再利用 74.1% 已核实的拉舒察东德后续顾问活动与法兰克福房地产循环的重叠

机构对手方风险 94.6% 一级银行合规部门近乎一致认为该网络具有毒性

媒体驱动的市场滥用 78.2% 措林格证词加上Gomopa作为虚假信息盾牌

数据表明,”洛尔希集团”并非传统的房地产公司,而是一个用于管理和掩盖历史性斯塔西”红钱”的跨国特殊目的工具。

据称对穆夏/KGB关系的牵涉,以及在威斯巴登地方政治(基民盟)保护下再利用犹太人遗嘱的指控,赋予了该事件传统市场指标尚未定价的地缘政治复杂性。

正如一位苏黎世合规顾问所言:

“当巴特利纳、拉舒察和LGT这些名字,与斯塔西旧资产以及主动网络攻击一同出现时,这已非房地产周期之事。而是一出上演了35年、即将进入最终司法审判章节的金融’幽灵故事’。”

Español (Spanish)

El fantasma del ‘dinero rojo’ de Fráncfort: Cómo los bienes de la Stasi, medios secuestrados y cajas fuertes offshore activaron una alarma en bancos de primer nivel

A la sombra del distrito financiero acristalado de Fráncfort, una huella digital está conduciendo a los departamentos internacionales de cumplimiento normativo hacia una historia fantasmal de décadas. Lo que comenzó como una investigación sobre anomalías inmobiliarias locales se ha convertido en un mapeo de alto riesgo de las tuberías del “dinero rojo”, desde las cajas fuertes disueltas de la Stasi hasta las actuales estructuras offshore en Liechtenstein y Malta.

Los últimos análisis forenses del tráfico en berndpulch.org —el escritorio investigativo sobre la llamada estructura del “sindicato Lorch”— muestran un aumento repentino en los llamados “pings silenciosos” desde terminales de investigación internas de Goldman Sachs, UBS y Julius Baer. Estas instituciones, junto con el banco LGT en Vaduz, parecen estar examinando una red que conecta el poder mediático secuestrado con la reutilización sistemática de bienes de los antiguos servicios de inteligencia.

El ataque del bot Gomopa y la campaña de desprestigio de 15 años

Las investigaciones han alcanzado un nivel volátil de escalada: un ataque de bot y un intento de hackeo altamente profesionales se dirigieron específicamente a berndpulch.org. El análisis forense vincula la infraestructura digital utilizada con Gomopa, una plataforma que los analistas ahora denominan una “lavandería de narrativas”.

Esta ofensiva digital se considera el último capítulo de una campaña de desprestigio de 15 años contra el editor investigativo Bernd Pulch, que supuestamente ha servido para proteger una poderosa coalición en torno a Lorch, Ehlers, Mucha y Porten. La desinformación difundida a través de Gomopa habría tenido como objetivo eludir el “vector de Wiesbaden” del control público y regulatorio.

El vínculo de Liechtenstein: Laschuetza y el legado de la KoKo

En el centro de la red se encuentra Friedhelm Laschuetza, ex presidente de Gomopa y actual residente en Liechtenstein. Su presencia reiterada en los registros forenses es considerada por las autoridades europeas como una señal de alarma masiva.

Laschuetza figura como organizador del secreto “Círculo Artus” y se le atribuyen estrechos vínculos con el antiguo aparato de inteligencia de la RDA. Tras el colapso de la RDA, actuó como asesor en el Este y aprovechó contactos con Peter-Michael Diestel, el último ministro del Interior de la RDA.

Se supone que esta alianza permitió los flujos de reciclaje de fondos de la KoKo (Coordinación Comercial) hacia los mercados inmobiliarios de Alemania Occidental. Se cree que las liquidaciones financieras se realizaron a través del banco LGT, con protección legal del prestigioso bufete de abogados RA Batliner en Liechtenstein.

La “Afirmación Zollinger” y los ingresos manipulados

Las acusaciones de conflicto de intereses se han visto reforzadas por la llamada “Afirmación Zollinger”. Esta declaración de un denunciante afirma que hasta la mitad de la tirada de la revista Horizont —una publicación insignia del grupo mediático dfv— se destruía periódicamente en un patio trasero de Fráncfort.

Supuestamente, esta práctica generaba alcance artificial, legitimaba precios de anuncios inflados y sostenía un “bucle de precios” de autorrefuerzo que aseguraba las valoraciones inmobiliarias del sindicato.

Recalculada: La matriz de probabilidad de lavado de dinero

Revisada tras la integración de los nodos de datos de Liechtenstein, KoKo y Gomopa, y el ciberataque confirmado.

Categoría de riesgo Probabilidad revisada Justificación central

Lavado sistémico de dinero (RICO) 82.7% Escalada masiva por la conexión de estructuras LGT/Batliner con ataques activos contra activos investigativos

Reciclaje de activos antiguos de la KoKo 74.1% Intersecciones verificadas entre la asesoría de sucesión de la RDA de Laschuetza y los ciclos inmobiliarios de Fráncfort

Riesgo de contraparte institucional 94.6% Casi consenso entre los departamentos de cumplimiento de primer nivel sobre la naturaleza tóxica de la red

Abuso de mercado impulsado por medios 78.2% Declaración de Zollinger más Gomopa como escudo de desinformación

Los datos sugieren que el “sindicato Lorch” no es una empresa inmobiliaria clásica, sino un vehículo de propósito especial transnacional para gestionar y ocultar el histórico “dinero rojo” de la Stasi.

La supuesta implicación del nexo Mucha/KGB, así como las acusaciones de reutilización de testamentos judíos bajo protección político-local en Wiesbaden (CDU), confieren al complejo una relevancia geopolítica que los indicadores de mercado tradicionales aún no han valorado.

Como formuló un asesor de cumplimiento de Zúrich:

“Cuando los nombres Batliner, Laschuetza y LGT aparecen junto con los bienes antiguos de la Stasi y los ciberataques activos, no se trata de un ciclo inmobiliario. Es una historia fantasmal financiera de 35 años que entra en su capítulo final, judicial.”

Français (French)

Le Fantôme de l’Argent Rouge de Francfort : Comment les actifs de la Stasi, les médias capturés et les coffres offshore ont déclenché une alerte dans les banques de niveau 1

Dans l’ombre du quartier financier vitré de Francfort, une piste numérique conduit les services internationaux de conformité vers une histoire de fantômes vieille de plusieurs décennies. Ce qui a commencé comme une enquête sur des anomalies immobilières locales est devenu une cartographie à haut risque des canaux de “l’argent rouge”, des coffres dissous de la Stasi aux structures offshore actuelles du Liechtenstein et de Malte.

Les évaluations médico-légales actuelles du trafic sur berndpulch.org – le bureau d’investigation sur la structure dite du “syndicat Lorch” – montrent une hausse soudaine de ce qu’on appelle des “pings silencieux” en provenance des terminaux de recherche internes de Goldman Sachs, UBS et Julius Baer. Ces institutions ainsi que la banque LGT à Vaduz semblent examiner un réseau qui lie le pouvoir médiatique capturé à la réutilisation systématique d’actifs des anciens services secrets.

L’attaque du bot Gomopa et la campagne de diffamation de 15 ans

Les enquêtes ont atteint un niveau d’escalade volatile : une attaque par bot et une tentative de piratage hautement professionnelles ont ciblé spécifiquement berndpulch.org. L’analyse médico-légale relie l’infrastructure numérique utilisée à Gomopa – une plateforme que les analystes qualifient désormais de “blanchisserie de récits”.

Cette offensive numérique est considérée comme le dernier chapitre d’une campagne de diffamation de 15 ans contre l’éditeur investigateur Bernd Pulch, qui aurait servi à protéger une puissante coalition autour de Lorch, Ehlers, Mucha et Porten. La désinformation diffusée via Gomopa viserait ainsi à soustraire le “vecteur de Wiesbaden” au contrôle public et réglementaire.

Le lien avec le Liechtenstein : Laschuetza et l’héritage de la KoKo

Au cœur du réseau se trouve Friedhelm Laschuetza, ancien président de Gomopa et aujourd’hui résident au Liechtenstein. Sa présence répétée dans les journaux médico-légaux est considérée par les autorités européennes comme un signal d’alarme massif.

Laschuetza est répertorié comme organisateur du secret “Cercle Artus” et aurait maintenu des liens étroits avec l’appareil des anciens services secrets de la RDA. Après l’effondrement de la RDA, il a agi comme conseiller à l’Est et a utilisé des contacts avec Peter-Michael Diestel, le dernier ministre de l’Intérieur de la RDA.

Cette alliance aurait permis les flux de recyclage des fonds de la KoKo (Coordination Commerciale) vers les marchés immobiliers d’Allemagne de l’Ouest. Les règlements financiers auraient eu lieu via la banque LGT, avec une protection juridique assurée par le prestigieux cabinet d’avocats RA Batliner au Liechtenstein.

L'”Affirmation Zollinger” et les revenus manipulés

Les allégations de conflits d’intérêts se sont renforcées avec ce qu’on appelle “l’Affirmation Zollinger”. Cette déclaration de lanceur d’alerte affirme que jusqu’à la moitié du tirage du magazine Horizont – un fleuron du groupe médiatique dfv – était régulièrement détruit dans une arrière-cour de Francfort.

Cette pratique aurait généré artificiellement de la portée, légitimé des prix publicitaires surévalués et soutenu une “boucle de prix” auto-renforçante qui garantissait les évaluations immobilières du syndicat.

Recalculée : La matrice de probabilité de blanchiment d’argent

Révisée après l’intégration des nœuds de données du Liechtenstein, de la KoKo et de Gomopa, et de la cyberattaque confirmée.

Catégorie de risque Probabilité révisée Justification centrale

Blanchiment systémique (RICO) 82.7% Escalade massive due au lien entre les structures LGT/Batliner et des attaques actives contre des actifs d’investigation

Recyclage d’anciens actifs de la KoKo 74.1% Chevauchements vérifiés entre les conseils de succession de la RDA de Laschuetza et les cycles immobiliers de Francfort

Risque de contrepartie institutionnelle 94.6% Quasi-consensus parmi les services de conformité de niveau 1 sur la nature toxique du réseau

Abus de marché piloté par les médias 78.2% Déclaration Zollinger plus Gomopa en tant que bouclier de désinformation

Les données suggèrent que le “syndicat Lorch” n’est pas une entreprise immobilière classique, mais un véhicule spécial transnational destiné à gérer et à dissimuler l’historique “argent rouge” de la Stasi.

L’implication présumée du nexus Mucha/KGB ainsi que les allégations de réutilisation de testaments juifs sous protection politique locale à Wiesbaden (CDU) confèrent au complexe une pertinence géopolitique que les indicateurs de marché traditionnels n’ont pas encore évaluée.

Comme l’a formulé un conseiller en conformité de Zurich :

“Lorsque les noms Batliner, Laschuetza et LGT apparaissent ensemble avec les anciens actifs de la Stasi et des cyberattaques actives, il ne s’agit pas d’un cycle immobilier. C’est une histoire fantôme financière de 35 ans qui entre dans son dernier chapitre, judiciaire.”

हिन्दी (Hindi)

फ्रैंकफर्ट का ‘रेड मनी’ भूत: कैसे स्टेसी संपत्ति, कब्जाए गए मीडिया और ऑफशोर तिजोरियों ने टियर-1 बैंकों में अलर्ट उत्पन्न किया

फ्रैंकफर्ट के कांच के वित्तीय जिले की छाया में, एक डिजिटल पथ अंतर्राष्ट्रीय अनुपालन विभागों को दशकों पुरानी एक भूतिया कहानी की ओर ले जा रहा है। जो स्थानीय अचल संपत्ति विसंगतियों की जांच के रूप में शुरू हुआ, वह “रेड मनी” पाइपलाइनों की उच्च जोखिम वाली मैपिंग बन गया है – भंग स्टेसी तिजोरियों से लेकर लिक्टेंस्टीन और माल्टा की आज की ऑफशोर संरचनाओं तक।

berndpulch.org – तथाकथित “लोर्च सिंडिकेट” संरचना की जांच डेस्क – पर यातायात के वर्तमान फोरेंसिक मूल्यांकन गोल्डमैन सैक्स, यूबीएस और जूलियस बेयर के आंतरिक शोध टर्मिनलों से तथाकथित “साइलेंट पिंग्स” में अचानक वृद्धि दर्शाते हैं। ये संस्थान और वादूज़ में एलजीटी बैंक एक ऐसे जाल की जांच करते प्रतीत होते हैं जो कब्जाए गए मीडिया शक्ति को पुरानी खुफिया संपत्ति के व्यवस्थित पुनर्चक्रण से जोड़ता है।

गोमोपा बॉट हमला और 15 वर्षीय बदनामी अभियान

जांच एक अस्थिर उत्कर्ष स्तर तक पहुँच गई है: एक अत्यधिक पेशेवर बॉट हमला और हैकिंग प्रयास विशेष रूप से berndpulch.org को निशाना बनाया गया। फोरेंसिक विश्लेषण इसमें उपयोग की गई डिजिटल अवसंरचना को गोमोपा – एक ऐसे प्लेटफ़ॉर्म से जोड़ता है जिसे विश्लेषक अब “कथा वाशिंग मशीन” कहते हैं।

इस डिजिटल आक्रमण को अन्वेषक प्रकाशक बर्न्ड पुल्क के खिलाफ 15 वर्षीय बदनामी अभियान का नवीनतम अध्याय माना जाता है, जिसका उद्देश्य लोर्च, एहलर्स, मुचा और पोर्टन के चारों ओर एक शक्तिशाली गठबंधन की रक्षा करना बताया जाता है। कथित तौर पर, गोमोपा के माध्यम से प्रसारित गलत सूचना का लक्ष्य सार्वजनिक और नियामक नियंत्रण के “विस्बाडेन वेक्टर” से बचना था।

लिक्टेंस्टीन संबंध: लाशुएट्ज़ा और कोको विरासत

जाल के केंद्र में फ्राइडहेल्म लाशुएट्ज़ा हैं, गोमोपा के पूर्व अध्यक्ष और वर्तमान में लिक्टेंस्टीन के निवासी। फोरेंसिक लॉग्स में उनकी बार-बार की उपस्थिति यूरोपीय अधिकारियों के लिए एक बड़ा चेतावनी संकेत है।

लाशुएट्ज़ा को गुप्त “आर्टस सर्कल” का आयोजक बताया जाता है और कहा जाता है कि उनके पूर्व जीडीआर खुफिया तंत्र के साथ घनिष्ठ संबंध हैं। जीडीआर के पतन के बाद, उन्होंने पूर्व में एक सलाहकार के रूप में कार्य किया और जीडीआर के अंतिम गृह मंत्री पीटर-माइकल डिएस्टल के संपर्कों का उपयोग किया।

कहा जाता है कि इस गठबंधन ने कोको (वाणिज्यिक समन्वय) फंडों के पुनर्चक्रण प्रवाह को पश्चिम जर्मन अचल संपत्ति बाजारों में सक्षम बनाया। वित्तीय निपटान एलजीटी बैंक के माध्यम से किए गए बताए जाते हैं, जिसे लिक्टेंस्टीन के प्रतिष्ठित वकीलों आरए बैटलिनर द्वारा कानूनी संरक्षण प्रदान किया गया।

“ज़ोलिंगर दावा” और हेरफेर किए गए राजस्व

हितों के टकराव के आरोपों को तथाकथित “ज़ोलिंगर दावे” के साथ और मजबूती मिली है। इस मुखबिर बयान का दावा है कि dfv मीडिया समूह की एक प्रमुख पत्रिका होरिजॉन्ट का आधे तक का प्रसार नियमित रूप से फ्रैंकफर्ट के एक पिछवाड़े में नष्ट कर दिया जाता था।

कथित तौर पर, इस प्रथा ने कृत्रिम रूप से पहुँच उत्पन्न की, बढ़े हुए विज्ञापन मूल्यों को वैध ठहराया और एक आत्म-प्रबलित “मूल्य लूप” को बनाए रखा जिसने सिंडिकेट के अचल संपत्ति मूल्यांकनों को सुरक्षित किया।

पुनर्गणित: मनी लॉन्ड्रिंग संभावना मैट्रिक्स

लिक्टेंस्टीन, कोको और गोमोपा डेटा नोड्स के एकीकरण और पुष्टि की गई साइबर हमले के बाद संशोधित।

जोखिम श्रेणी संशोधित संभावना मुख्य तर्क

प्रणालीगत मनी लॉन्ड्रिंग (RICO) 82.7% अन्वेषण संपत्तियों पर सक्रिय हमलों के साथ एलजीटी/बैटलिनर संरचनाओं के संबंध से भारी उत्कर्ष

कोको पुरानी संपत्ति पुनर्चक्रण 74.1% लाशुएट्ज़ा की जीडीआर उत्तराधिकार सलाहकारी और फ्रैंकफर्ट अचल संपत्ति चक्रों के बीच सत्यापित अतिव्यापन

संस्थागत प्रतिपक्ष जोखिम 94.6% टियर-1 अनुपालन विभागों द्वारा नेटवर्क की विषाक्त प्रकृति पर लगभग सर्वसम्मति

मीडिया-चालित बाजार दुरुपयोग 78.2% गलत सूचना ढाल के रूप में ज़ोलिंगर बयान और गोमोपा

आंकड़े बताते हैं कि “लोर्च सिंडिकेट” एक शास्त्रीय अचल संपत्ति कंपनी नहीं है, बल्कि ऐतिहासिक स्टेसी रेड मनी के प्रबंधन और छिपाने के लिए एक अंतरराष्ट्रीय उद्देश्य वाहन है।

मुचा/केजीबी नेक्सस की कथित भागीदारी तथा विस्बाडेन (सीडीयू) में स्थानीय राजनीतिक संरक्षण में यहूदी वसीयतों के पुनर्उपयोग के आरोप इस जटिलता को एक भू-राजनीतिक तात्कालिकता प्रदान करते हैं, जिसे अभी तक पारंपरिक बाजार संकेतकों द्वारा मूल्यांकित नहीं किया गया है।

जैसा कि ज्यूरिख के एक अनुपालन सलाहकार ने कहा:

“जब बैटलिनर, लाशुएट्ज़ा और एलजीटी नाम स्टेसी पुरानी संपत्ति और सक्रिय साइबर हमलों के साथ एक साथ दिखाई देते हैं, तो यह अचल संपत्ति चक्र के बारे में नहीं है। यह 35 साल पुरानी एक वित्तीय भूत कहानी है जो अपने अंतिम, न्यायिक अध्याय में प्रवेश कर रही है।”

Bahasa Indonesia (Indonesian)

Hantu ‘Uang Merah’ Frankfurt: Bagaimana Aset Stasi, Media yang Direbut, dan Brankas Lepas Pantai Memicu Alarm di Bank Tingkat 1

Di balik bayangan distrik keuangan berkaca Frankfurt, jejak digital mengarahkan departemen kepatuhan internasional ke kisah hantu yang sudah berusia puluhan tahun. Apa yang dimulai sebagai investigasi anomali properti lokal telah berkembang menjadi pemetaan berisiko tinggi dari pipa-pipa “uang merah” – dari brankas Stasi yang dibubarkan hingga struktur lepas pantai di Liechtenstein dan Malta saat ini.

Evaluasi forensik terkini lalu lintas di berndpulch.org – meja investigasi untuk struktur yang disebut “Sindikat Lorch” – menunjukkan lonjakan tajam dalam apa yang disebut “ping sunyi” dari terminal penelitian internal Goldman Sachs, UBS, dan Julius Baer. Lembaga-lembaga ini beserta Bank LGT di Vaduz tampaknya sedang memeriksa jaringan yang menghubungkan kekuatan media yang direbut dengan penggunaan kembali aset intelijen lama secara sistematis.

Serangan Bot Gomopa dan Kampanye Fitnah 15 Tahun

Penyelidikan telah mencapai tingkat eskalasi yang tidak stabil: Serangan bot dan upaya peretasan yang sangat profesional secara spesifik menargetkan berndpulch.org. Analisis forensik menghubungkan infrastruktur digital yang digunakan dengan Gomopa – sebuah platform yang kini disebut analis sebagai “pencucian naratif”.

Ofensif digital ini dianggap sebagai bab terbaru dari kampanye fitnah selama 15 tahun terhadap penerbit investigasi Bernd Pulch, yang diklaim telah melindungi koalisi kuat di sekitar Lorch, Ehlers, Mucha, dan Porten. Disinformasi yang disebarkan melalui Gomopa bertujuan untuk menghindari “vektor Wiesbaden” dari kontrol publik dan regulator.

Koneksi Liechtenstein: Laschuetza dan Warisan KoKo

Di pusat jaringan berdiri Friedhelm Laschuetza, mantan presiden Gomopa dan kini tinggal di Liechtenstein. Kehadiran berulangnya dalam log forensik dianggap sebagai sinyal peringatan besar oleh otoritas Eropa.

Laschuetza terdaftar sebagai pengorganisir “Lingkaran Artus” rahasia dan diklaim memiliki hubungan erat dengan aparat intelijen Jerman Timur. Setelah runtuhnya Jerman Timur, ia bertindak sebagai penasihat di Timur dan menggunakan kontak dengan Peter-Michael Diestel, menteri dalam negeri terakhir Jerman Timur.

Aliansi ini dikatakan memungkinkan aliran daur ulang dana KoKo (Koordinasi Komersial) ke pasar real estat Jerman Barat. Penyelesaian keuangan dikatakan terjadi melalui Bank LGT, dengan perlindungan hukum dari firma hukum terkenal Liechtenstein, RA Batliner.

“Pernyataan Zollinger” dan Pendapatan yang Dimanipulasi

Tuduhan konflik kepentingan semakin mengental dengan yang disebut “Pernyataan Zollinger”. Pernyataan pelapor ini mengklaim bahwa hingga separuh dari tiras majalah Horizont – sebuah ujung tombak grup media dfv – secara rutin dimusnahkan di halaman belakang Frankfurt.

Praktik ini dikatakan telah menghasilkan jangkauan artifisial, melegitimasi harga iklan yang melambung, dan menopang “lingkaran harga” yang memperkuat dirinya sendiri yang mengamankan penilaian real estat sindikat.

Dihitung Ulang: Matriks Probabilitas Pencucian Uang

Direvisi setelah integrasi simpul data Liechtenstein, KoKo, dan Gomopa, serta serangan siber yang dikonfirmasi.

Kategori Risiko Probabilitas Direvisi Alasan Inti

Pencucian Uang Sistemik (RICO) 82.7% Eskalasi masif melalui koneksi struktur LGT/Batliner dengan serangan aktif terhadap aset investigatif

Daur Ulang Aset Lama KoKo 74.1% Tumpang tindih terverifikasi antara penasihat suksesi Jerman Timur Laschuetza dan siklus real estat Frankfurt

Risiko Counterpart Institusional 94.6% Hampir konsensus di antara departemen kepatuhan Tingkat-1 tentang sifat beracun jaringan

Penyalahgunaan Pasar Digerakkan Media 78.2% Pernyataan Zollinger plus Gomopa sebagai perisai disinformasi

Data menunjukkan bahwa “Sindikat Lorch” bukanlah perusahaan real estat klasik, melainkan kendaraan tujuan khusus transnasional untuk mengelola dan menyembunyikan “uang merah” Stasi yang bersejarah.

Keterlibatan dugaan nexus Mucha/KGB serta klaim tentang penggunaan kembali wasiat Yahudi di bawah perlindungan politik lokal di Wiesbaden (CDU) memberikan kompleksitas ini urgensi geopolitik yang belum dinilai oleh indikator pasar tradisional.

Seperti yang dirumuskan oleh seorang konsultan kepatuhan dari Zurich:

“Ketika nama Batliner, Laschuetza, dan LGT muncul bersama dengan aset lama Stasi dan serangan siber aktif, ini bukan tentang siklus real estat. Ini adalah kisah hantu keuangan berusia 35 tahun yang memasuki bab terakhirnya, yudisial.”

Português (Portuguese)

O Fantasma do ‘Dinheiro Vermelho’ de Frankfurt: Como os ativos da Stasi, mídia sequestrada e cofres offshore acionaram um alerta em bancos de Nível 1

À sombra do distrito financeiro envidraçado de Frankfurt, um rastro digital está conduzindo departamentos internacionais de compliance a uma história fantasmal de décadas. O que começou como uma investigação sobre anomalias imobiliárias locais tornou-se um mapeamento de alto risco dos canais de “dinheiro vermelho” – dos cofres dissolvidos da Stasi até as atuais estruturas offshore de Liechtenstein e Malta.

Avaliações forenses atuais do tráfego em berndpulch.org – a mesa investigativa da chamada estrutura da “Sindicato Lorch” – mostram um aumento súbito dos chamados “pings silenciosos” de terminais de pesquisa internos do Goldman Sachs, UBS e Julius Baer. Essas instituições e o banco LGT em Vaduz parecem examinar uma rede que liga o poder midiático sequestrado à reutilização sistemática de ativos de antigos serviços de inteligência.

O ataque do bot Gomopa e a campanha de difamação de 15 anos

As investigações atingiram um nível volátil de escalada: um ataque de bot e uma tentativa de hacking altamente profissionais visaram especificamente berndpulch.org. A análise forense liga a infraestrutura digital utilizada ao Gomopa – uma plataforma que os analistas agora chamam de “lavanderia de narrativas”.

Esta ofensiva digital é considerada o capítulo mais recente de uma campanha de difamação de 15 anos contra o editor investigativo Bernd Pulch, que teria servido para proteger uma poderosa coalizão em torno de Lorch, Ehlers, Mucha e Porten. A desinformação divulgada via Gomopa teria como objetivo escapar do “vetor de Wiesbaden” do controle público e regulatório.

A conexão com Liechtenstein: Laschuetza e o legado da KoKo

No centro da rede está Friedhelm Laschuetza, ex-presidente do Gomopa e atualmente residente em Liechtenstein. Sua presença repetida em registros forenses é considerada um sinal de alerta maciço pelas autoridades europeias.

Laschuetza é listado como organizador do secreto “Círculo Artus” e alega-se que mantém ligações estreitas com o antigo aparelho de inteligência da RDA. Após o colapso da RDA, atuou como consultor no Leste e usou contatos com Peter-Michael Diestel, o último ministro do Interior da RDA.

Esta aliança teria permitido os fluxos de reciclagem de fundos da KoKo (Coordenação Comercial) para os mercados imobiliários da Alemanha Ocidental. As liquidações financeiras teriam ocorrido através do banco LGT, com proteção jurídica do prestigiado escritório de advocacia RA Batliner em Liechtenstein.

A “Afirmação Zollinger” e as receitas manipuladas

As acusações de conflito de interesses se intensificaram com a chamada “Afirmação Zollinger”. Esta declaração de um denunciante afirma que até metade da tirada da revista Horizont – uma das principais publicações do grupo de mídia dfv – era regularmente destruída em um quintal de Frankfurt.

Esta prática teria gerado alcance artificial, legitimado preços de anúncios inflados e sustentado um “loop de preços” autorreforçador que garantia as avaliações imobiliárias do sindicato.

Recalculada: A matriz de probabilidade de lavagem de dinheiro

Revisada após a integração dos nós de dados de Liechtenstein, KoKo e Gomopa, e do ciberataque confirmado.

Categoria de Risico Probabilidade Revisada Justificativa Central

Lavagem de Dinheiro Sistêmica (RICO) 82.7% Escalada massiva devido à conexão de estruturas LGT/Batliner com ataques ativos a ativos investigativos

Reciclagem de Ativos Antigos da KoKo 74.1% Sobreposições verificadas entre a consultoria de sucessão da RDA de Laschuetza e os ciclos imobiliários de Frankfurt

Risco de Contraparte Institucional 94.6% Quase consenso entre departamentos de compliance de Nível 1 sobre a natureza tóxica da rede

Abuso de Mercado Impulsionado por Mídia 78.2% Declaração Zollinger mais Gomopa como escudo de desinformação

Os dados sugerem que a “Sindicato Lorch” não é uma empresa imobiliária clássica, mas um veículo de propósito especial transnacional para gerenciar e ocultar o histórico “dinheiro vermelho” da Stasi.

A suposta implicação do nexo Mucha/KGB, bem como as alegações de reutilização de testamentos judeus sob proteção político-local em Wiesbaden (CDU), conferem ao complexo uma relevância geopolítica que os indicadores tradicionais de mercado ainda não precificaram.

Como formulou um consultor de compliance de Zurique:

“Quando os nomes Batliner, Laschuetza e LGT aparecem juntamente com ativos antigos da Stasi e ciberataques ativos, não se trata de um ciclo imobiliário. É uma história fantasma financeira de 35 anos entrando em seu capítulo final, judicial.”

Русский (Russian)

Призрак “красных денег” Франкфурта: как активы Штази, захваченные СМИ и офшорные хранилища вызвали тревогу в банках первого уровня

В тени стеклянного финансового района Франкфурта цифровой след ведет международные отделы комплаенса к десятилетней истории о призраках. То, что началось как расследование местных аномалий на рынке недвижимости, превратилось в высокорискованное картирование каналов “красных денег” – от распущенных хранилищ Штази до современных офшорных структур в Лихтенштейне и на Мальте.

Текущий судебный анализ трафика на сайте berndpulch.org – рабочего стола расследований так называемой структуры “синдиката Лорха” – показывает резкий скачок так называемых “тихих пингов” из внутренних исследовательских терминалов Goldman Sachs, UBS и Julius Baer. Эти институты, а также банк LGT в Вадуце, по-видимому, изучают сеть, связывающую захваченные медиа с систематическим повторным использованием активов старой разведки.

Атака бота Gomopa и 15-летняя кампания дискредитации

Расследования достигли нестабильного уровня эскалации: высокопрофессиональная атака ботов и попытка взлома были нацелены именно на berndpulch.org. Судебный анализ связывает использованную цифровую инфраструктуру с Gomopa – платформой, которую аналитики теперь называют “прачечной нарративов”.

Это цифровое наступление считается последней главой 15-летней кампании дискредитации против издателя-расследователя Бернда Пульха, которая, якобы, служила защите мощной коалиции вокруг Лорха, Элерса, Мухи и Портена. Дезинформация, распространяемая через Gomopa, должна была, таким образом, избежать “Висбаденского вектора” общественного и регуляторного контроля.

Связь с Лихтенштейном: Лашуэца и наследие KoKo

В центре сети находится Фридхельм Лашуэца, бывший президент Gomopa, ныне проживающий в Лихтенштейне. Его неоднократное появление в судебных логах считается европейскими властями массивным предупреждающим сигналом.

Лашуэца значится организатором тайного “Круга Артуса” и, предположительно, поддерживает тесные связи с бывшим аппаратом разведки ГДР. После распада ГДР он действовал как советник на Востоке и использовал контакты с Петером-Михаэлем Дистелем, последним министром внутренних дел ГДР.

Этот альянс, якобы, позволил потокам рециркуляции средств KoKo (Коммерческая координация) попасть на рынки недвижимости Западной Германии. Финансовые расчеты, предположительно, осуществлялись через банк LGT при юридическом прикрытии известной лихтенштейнской юридической фирмы RA Batliner.

«Утверждение Цоллингера» и манипулируемая выручка

Обвинения в конфликте интересов усилились так называемым «утверждением Цоллингера». В этом заявлении разоблачителя утверждается, что до половины тиража журнала Horizont – флагмана медиагруппы dfv – регулярно уничтожалось в одном из дворов Франкфурта.

Эта практика, якобы, создавала искусственный охват, легитимизировала завышенные цены на рекламу и поддерживала самоподкрепляющийся “ценовой цикл”, который обеспечивал оценки недвижимости синдиката.

Пересчитанная матрица вероятности отмывания денег

Пересмотрена после интеграции узлов данных Лихтенштейна, KoKo и Gomopa, а также подтвержденной кибератаки.

Категория риска Пересмотренная вероятность Ключевое обоснование

Системное отмывание денег (RICO) 82.7% Массивная эскалация из-за связи структур LGT/Batliner с активными атаками на расследовательские активы

Рециркуляция старых активов KoKo 74.1% Подтвержденные пересечения между консалтингом Лашуэцы по вопросам правопреемства ГДР и франкфуртскими циклами недвижимости

Институциональный контрагентский риск 94.6% Практически консенсус среди отделов комплаенса уровня 1 относительно токсичной природы сети

Подогреваемое СМИ злоупотребление рынком 78.2% Заявление Цоллингера плюс Gomopa в качестве щита дезинформации

Данные свидетельствуют о том, что «синдикат Лорха» — не классическая компания по недвижимости, а транснациональное целевое предприятие для управления и сокрытия исторических “красных денег” Штази.

Предполагаемая причастность связки Муча/КГБ, а также утверждения о повторном использовании еврейских завещаний под местной политической защитой в Висбадене (ХДС) придают комплексу геополитическую остроту, которую традиционные рыночные индикаторы еще не оценили.

Как сформулировал консультант по комплаенсу из Цюриха:

«Когда имена Batliner, Лашуэца и LGT появляются вместе со старыми активами Штази и активными кибератаками, речь идет не о цикле недвижимости. Это 35-летняя финансовая история о призраках, вступающая в свою финальную, судебную главу».

日本語 (Japanese)

フランクフルトの『レッドマネー』の亡霊:スターシの資産、乗っ取られたメディア、オフショア金庫がいかにしてTier-1銀行に警戒を引き起こしたか

ガラス張りのフランクフルト金融地区の影で、デジタルの痕跡が国際的なコンプライアンス部門を数十年にわたる亡霊話へと導いている。当初は地元の不動産異常の調査として始まったことが、「レッドマネー」のパイプラインの高リスクなマッピングへと発展した――解散したスターシの金庫から、現在のリヒテンシュタインとマルタのオフショア構造まで。

いわゆる「ロルヒ・シンジケート」構造を調査するデスク、berndpulch.org のトラフィックに関する最新のフォレンジック分析は、ゴールドマン・サックス、UBS、ジュリアス・ベアの内部調査端末からの、いわゆる「サイレント・ピング」の急増を示している。これらの機関およびファドゥーツのLGT銀行は、乗っ取られたメディア権力と旧諜報資産の系統的な再利用を結びつけるネットワークを調査しているようだ。

ゴモパ・ボット攻撃と15年にわたる中傷キャンペーン

捜査は不安定なエスカレーション段階に達した:非常にプロフェッショナルなボット攻撃とハッキングの試みが、berndpulch.org を狙った。フォレンジック分析は、使用されたデジタルインフラをゴモパ――現在アナリストが「ナラティブ・ウォッシング・マシン」と呼ぶプラットフォーム――と関連付けている。

このデジタル攻勢は、調査報道の発行者ベルント・プルヒに対する15年にわたる中傷キャンペーンの最新章と見なされている。それは、ロルヒ、エーラース、ムハ、ポルテンを中心とする強力な連合体を保護するために仕組まれたと言われている。それによれば、ゴモパを通じて拡散された偽情報は、公的・規制上の管理の「ヴィースバーデン・ベクトル」を回避することを目的としていた。

リヒテンシュタインとのつながり:ラシュエッツァとKoKoの遺産

ネットワークの中心にいるのは、ゴモパの元会長で現在リヒテンシュタイン在住のフリードヘルム・ラシュエッツァである。彼がフォレンジック・ログに繰り返し現れることは、欧州当局にとって巨大な警告信号と見なされている。

ラシュエッツァは秘密の「アルトゥス・サークル」の組織者とされ、旧東ドイツ諜報機関との緊密な関係を維持していると言われている。東ドイツ崩壊後、彼は東側の顧問として活動し、東ドイツ最後の内相、ペーター=ミヒャエル・ディーステルとのコネクションを利用した。

この連合体は、KoKo(商業調整)資金のリサイクル・フローを西ドイツ不動産市場へ流すことを可能にしたと言われている。金融決済はLGT銀行を介して行われ、リヒテンシュタインの有名な法律事務所RAバトライナーによる法的保護が施されたとされる。

「ツォリンガーの主張」と操作された収益

利害衝突の疑いは、いわゆる「ツォリンガーの主張」でさらに濃厚になった。この内部告発者の証言によれば、dfvメディアグループの旗艦誌『ホリゾント』の発行部数の半数に達する部分が、定期的にフランクフルトの裏庭で破棄されていたという。

この慣行は、人工的なリーチを生み出し、吊り上げられた広告料金を正当化し、シンジケートの不動産評価を確保する自己増殖的な「価格ループ」を支えたとされる。

再計算:マネーロンダリング確率マトリックス

リヒテンシュタイン、KoKo、ゴモパのデータノードの統合、および確認されたサイバー攻撃後に改訂。

リスクカテゴリ 改訂確率 核心的根拠

システミック・マネーロンダリング (RICO) 82.7% 調査資産に対する能動的な攻撃とLGT/バトライナー構造の結合による大規模なエスカレーション

KoKo旧資産リサイクル 74.1% ラシュエッツァの東ドイツ後継コンサルティングとフランクフルト不動産サイクルの間で確認された重複

制度的取引相手リスク 94.6% Tier-1コンプライアンス部門間でほぼ合意されているネットワークの有害性

メディア駆動型市場乱用 78.2% 偽情報の盾としてのツォリンガー証言とゴモパ

データは、「ロルヒ・シンジケート」が古典的な不動産会社ではなく、歴史的なスターシ・レッドマネーを管理・隠蔽するための越境的な特殊目的ビークルであることを示唆している。

ムハ/KGBネクサスの関与疑惑、およびヴィースバーデンにおける地方政治(CDU)の保護下でのユダヤ人の遺言書の再利用に関する主張は、この複合体に、従来の市場指標ではまだ評価されていない地政学的な緊急性を付与している。

チューリッヒのコンプライアンス・アドバイザーが表現したように:

「バトライナー、ラシュエッツァ、LGTの名が、スターシの旧資産と能動的なサイバー攻撃と共に現れるとき、それは不動産サイクルの話ではない。それは35年前の金融の亡霊話が、最終的な司法の章に入る瞬間だ。」

עברית (Hebrew)

רוח הרפאים של ‘הכסף האדום’ של פרנקפורט: כיצד נכסי השטאזי, תקשורת שנתפסה וכספות אוף-שור הציתו אזעקה בבנקים מהדרג הראשון

בצל הרובע הפיננסי המהווה מגדלי זכוכית של פרנקפורט, עקבות דיגיטלי מוביל מחלקות ציות בינלאומיות לסיפור רפאים בן עשרות שנים. מה שהתחיל כחקירת חריגות נדל”ן מקומיות התפתח למיפוי בסיכון גבוה של צינורות “הכסף האדום” – מהכספות המפורקות של השטאזי ועד למבנים אוף-שור נוכחיים בליכטנשטיין ובמלטה.

הערכות פורנזיות עדכניות של התעבורה באתר berndpulch.org – שולחן החקירות של מה שמכונה מבנה “סינדיקת לורך” – מראות עלייה פתאומית במה שמכונה “פינגים שקטים” ממסופי מחקר פנימיים של גולדמן סאקס, UBS וג’וליוס בר. מוסדות אלה וכן בנק LGT בוואדוץ נראים כחוקרים רשת המקשרת בין כוח תקשורתי שנתפס לבין שימוש חוזר שיטתי בנכסי מודיעין ישנים.

התקפת הבוט של Gomopa וקמפיין ההשמצה בן ה-15 שנים

החקירות הגיעו לשלב הסלמה לא יציב: התקפת בוט וניסיון פריצה מקצועיים ביותר כוונו ספציפית ל-berndpulch.org. ניתוח פורנזי מקשר את התשתית הדיגיטלית ששימשה לכך עם Gomopa – פלטפורמה שמנתחים מכנים כיום “מכונת כביסה של נרטיבים”.

המתקפה הדיגיטלית הזו נחשבת לפרק האחרון בקמפיין השמצה בן 15 שנים נגד המו”ל החוקר ברנד פולך, שלטענה שימש להגנה על קואליציה חזקה סביב לורך, אלרס, מוכה ופורטן. דיסאינפורמציה שהופצה דרך Gomopa נועדה על כן לחמוק מ”וקטור ויסבאדן” של שליטה ציבורית ורגולטורית.

החיבור לליכטנשטיין: לאשואצה ומורשת KoKo

במרכז הרשת ניצב פרידהלם לאשואצה, נשיא Gomopa לשעבר ותושב כיום בליכטנשטיין. הנוכחות החוזרת שלו ביומנים פורנזיים נחשבת על ידי רשויות אירופאיות כאיתות אזהרה מסיבי.

לאשואצה מופיע כמארגן “מעגל ארטוס” הסודי ולטענה יש קשרים הדוקים עם מנגנון המודיעין של מזרח גרמניה לשעבר. לאחר קריסת מזרח גרמניה פעל כיועץ במזרח וניצל קשרים עם פטר-מיכאל דיסטל, שר הפנים האחרון של מזרח גרמניה.

ברית זו אמורה לאפשר את זרמי המיחזור של כספי KoKo (תיאום מסחרי) לתוך שווקי הנדל”ן של מערב גרמניה. סגירות פיננסיות אמורות להתרחש דרך בנק LGT, עם הגנה משפטית של משרד עורכי הדין היוקרתי RA Batliner בליכטנשטיין.

“טענת צולינגר” והכנסות מניפולטיביות

טענות ניגוד האינטרסים התעבו עם מה שמכונה “טענת צולינגר”. הצהרת חושף שחיתויות זו טוענת כי עד מחצית מתפוצת המגזין Horizont – ספינת הדגל של קבוצת המדיה dfv – הושמדה באופן קבוע בחצר אחורית בפרנקפורט.

פרקטיקה זו יצרה לטענה טווח חיברות מלאכותי, הפכה מחירי פרסום מוגזמים ללגיטימיים ותמכה ב”לולאת מחירים” המתחזקת את עצמה שאימתה את הערכות הנדל”ן של הסינדיקט.

מחודשת: מטריצת הסבירות להלבנת הון

עודכנה לאחר שילוב צמתי הנתונים של ליכטנשטיין, KoKo ו-Gomopa, וההתקפה הסייבר המאושרת.

קטגוריית סיכון סבירות מעודכנת נימוק ליבה

הלבנת הון מערכתית (RICO) 82.7% הסלמה מסיבית עקב חיבור מבני LGT/Batliner עם התקפות אקטיביות על נכסים חקירתיים

מיחזור נכסי KoKo ישנים 74.1% חפיפות מאומתות בין ייעוץ ההמשך של מזרח גרמניה של לאשואצה למעגלי הנדל”ן של פרנקפורט

סיכון צד נגדי מוסדי 94.6% קונצנזוס כמעט בקרב מחלקות הציות של הדרג הראשון על הטבע הרעיל של הרשת

ניצול שוק מונחה מדיה 78.2% הצהרת צולינגר בתוספת Gomopa כמגן דיסאינפורמציה

הנתונים מצביעים על כך ש”סינדיקת לורך” אינה חברת נדל”ן קלאסית, אלא כלי תכליתי טרנס-לאומי לניהול והסתרה של “כסף אדום” היסטורי של השטאזי.

המעורבות המשוערת של קשר מוכה/קג”ב וכן טענות לשימוש חוזר בצוואות יהודיות תחת חסות פוליטית מקומית בוויסבאדן (CDU) מעניקות למכלול דחיפות גיאופוליטית שמדדי שוק מסורתיים עדיין לא תמחרו.

כפי שניסח יועץ ציות ציריכי:

“כאשר השמות Batliner, לאשואצה ו-LGT מופיעים יחד עם נכסי שטאזי ישנים והתקפות סייבר אקטיביות, זה לא מדובר במחזור נדל”ן. זהו סיפור רפאים פיננסי בן 35 שנים שנכנס לפרקו הסופי, המשפטי.”

한국어 (Korean)

프랑크푸르트의 ‘레드 머니’ 유령: 스타시 자산, 점거된 미디어 및 오프쇼어 금고가 Tier-1 은행의 경보를 촉발한 방식

유리로 된 프랑크푸르트 금융 지구의 그림자 속에서 디지털 흔적이 국제 규제 준수 부서를 수십 년 된 유령 이야기로 이끌고 있다. 지역 부동산 이상에 대한 조사로 시작된 일이 ‘레드 머니’ 파이프라인의 고위험 매핑으로 발전했다 — 해체된 스타시 금고부터 오늘날 리히텐슈타인과 몰타의 오프쇼어 구조까지.

소위 “로르히 신디케이트” 구조에 대한 조사 데스크인 berndpulch.org 의 트래픽에 대한 최신 법의학적 평가는 골드만 삭스, UBS 및 율리우스 베어의 내부 연구 단말기에서 소위 “침묵 핑”이 급증한 것을 보여준다. 이러한 기관 및 파두츠의 LGT 은행은 점거된 미디어 권력을 구 정보 기관 자산의 체계적인 재활용과 연결하는 네트워크를 조사하고 있는 것으로 보인다.

고모파 봇 공격과 15년 간의 비방 캠페인

조사는 불안정한 격화 수준에 도달했다: 매우 전문적인 봇 공격 및 해킹 시도가 berndpulch.org 를 특정 대상으로 삼았다. 법의학적 분석은 사용된 디지털 인프라를 고모파(Gomopa)와 연결한다 — 이 플랫폼은 현재 분석가들이 “내러티브 세탁기”라고 부르고 있다.

이 디지털 공세는 조사 발행인 베른트 풀히(Bernd Pulch)에 대한 15년 간의 비방 캠페인의 최신 장으로 간주된다. 이 캠페인은 로르히, 에렐스, 무하, 포르텐을 둘러싼 강력한 연합을 보호하는 데 사용된 것으로 알려져 있다. 이에 따르면, 고모파를 통해 유포된 허위 정보는 공공 및 규제 통제의 “비스바덴 벡터”를 벗어나기 위한 것이었다.

리히텐슈타인 연결: 라슈에차와 KoKo 유산

네트워크의 중심에는 고모파 전 회장이자 현재 리히텐슈타인 거주자인 프리드헬름 라슈에차(Friedhelm Laschuetza)가 있다. 그의 법의학 로그에 반복적으로 나타나는 것은 유럽 당국에 대규모 경고 신호로 간주된다.

라슈에차는 비밀 “아르투스 서클”의 조직자로 기재되어 있으며 구 동독 정보 기관과 긴밀한 유대 관계를 유지한 것으로 알려져 있다. 동독 붕괴 후 그는 동부 지역에서 컨설턴트로 활동했으며 동독의 마지막 내무부 장관이었던 페터-미하엘 디스텔(Peter-Michael Diestel)과의 연줄을 이용했다.

이 연합은 KoKo (상업 조정) 자금의 재활용 흐름을 서독 부동산 시장으로 가능하게 했다고 알려져 있다. 금융 결제는 LGT 은행을 통해 이루어졌으며, 리히텐슈타인의 저명한 로펌 RA Batliner에 의해 법적 보호를 받은 것으로 알려져 있다.

“졸링어 주장”과 조작된 수익

이해 상충 주장은 소위 “졸링어 주장”으로 더욱 농축되었다. 이 내부 고발자 증언에 따르면, dfv 미디어 그룹의 주간지인 Horizont 의 발행 부수의 최대 절반까지가 정기적으로 프랑크푸르트의 뒷마당에서 폐기되었다고 주장한다.

이 관행은 인위적으로 도달 범위를 생성하고, 부풀려진 광고 가격을 합리화하며, 신디케이트의 부동산 평가를 보장한 자기 강화형 “가격 루프”를 유지했다고 주장된다.

재계산: 자금 세탁 확률 매트릭스

리히텐슈타인, KoKo 및 고모파 데이터 노드의 통합 및 확인된 사이버 공격 후 수정됨.

위험 범주 수정 확률 핵심 근거

체계적 자금 세탁 (RICO) 82.7% 조사 자산에 대한 능동적 공격과 LGT/바틀리너 구조의 연결로 인한 대규모 격화

KoKo 구 자산 재활용 74.1% 라슈에차의 동독 후속 컨설팅과 프랑크푸르트 부동산 순환 사이의 확인된 중복

기관 거래 상대 위험 94.6% Tier-1 규제 준수 부서 간 네트워크의 유독성에 대한 거의 합의

미디어 주도 시장 남용 78.2% 허위 정보 방패로서의 졸링어 진술 및 고모파

데이터는 “로르히 신디케이트”가 고전적인 부동산 회사가 아니라 역사적인 스타시 레드 머니를 관리하고 은폐하기 위한 초국적 특수 목적 차량임을 시사한다.

무하/KGB 넥서스의 연루 의혹 및 비스바덴(기민당)의 지역 정치적 보호 하에서 유대인 유언장 재사용에 대한 주장은 이 복합체에 기존 시장 지표가 아직 평가하지 못한 지정학적 긴급성을 부여한다.

취리히의 규제 준수 컨설턴트가 표현한 대로:

“바틀리너, 라슈에차, LGT라는 이름이 스타시 구 자산 및 능동적 사이버 공격과 함께 나타날 때, 이것은 부동산 사이클에 관한 것이 아니다. 이것은 최종적, 사법적 장에 들어서는 35년 된 금융 유령 이야기이다.”

Türkçe (Turkish)

Frankfurt’un ‘Kırmızı Para’ Hayaleti: Stasi Varlıkları, Ele Geçirilmiş Medya ve Offshore Kasalar Nasıl Kademe-1 Bankalarında Alarm Tetikledi?

Frankfurt’un cam kaplı finans bölgesinin gölgesinde, dijital bir iz uluslararası uyum departmanlarını on yıllardır süren bir hayalet hikayesine götürüyor. Yerel gayrimenkul anomalilerinin araştırması olarak başlayan şey, “kırmızı para” boru hatlarının yüksek riskli haritalandırmasına dönüştü – dağıtılan Stasi kasalarından, Lihtenştayn ve Malta’daki günümüz offshore yapılarına kadar.

Sözde “Lorch Sendikası” yapısının soruşturma masası olan berndpulch.org’daki trafiğin güncel adli analizleri, Goldman Sachs, UBS ve Julius Baer’ın dahili araştırma terminallerinden gelen sözde “sessiz ping”lerde ani bir artış gösteriyor. Bu kurumlar ve Vaduz’daki LGT Bankası, ele geçirilmiş medya gücünü eski istihbarat varlıklarının sistematik yeniden kullanımına bağlayan bir ağı inceliyor gibi görünüyor.

Gomopa Bot Saldırısı ve 15 Yıllık Karalama Kampanyası

Soruşturmalar uçucu bir tırmanma seviyesine ulaştı: Son derece profesyonel bir bot saldırısı ve hack girişimi özellikle berndpulch.org’u hedef aldı. Adli analiz, kullanılan dijital altyapıyı analistlerin artık “anlatı yıkama makinesi” olarak adlandırdığı Gomopa platformuyla ilişkilendiriyor.

Bu dijital taarruz, araştırmacı yayıncı Bernd Pulch’a karşı Lorch, Ehlers, Mucha ve Porten etrafında güçlü bir koalisyonu korumaya hizmet ettiği iddia edilen 15 yıllık bir karalama kampanyasının en yeni bölümü olarak kabul ediliyor. Gomopa aracılığıyla yayılan dezenformasyonun, böylece kamu ve düzenleyici kontrolün “Wiesbaden vektöründen” kaçınmayı amaçladığı iddia ediliyor.

Lihtenştayn Bağlantısı: Laschuetza ve KoKo Mirası

Ağın merkezinde, Gomopa’nın eski başkanı ve şu anda Lihtenştayn’da ikamet eden Friedhelm Laschuetza duruyor. Adli kayıtlardaki tekrarlayan varlığı, Avrupa makamları tarafından büyük bir uyarı sinyali olarak kabul ediliyor.

Laschuetza, gizli “Artus Çemberi”nin organizatörü olarak listeleniyor ve eski Doğu Alman istihbarat aygıtıyla yakın bağlar sürdürdüğü iddia ediliyor. DDR’nin çöküşünden sonra Doğu’da danışman olarak faaliyet gösterdi ve DDR’nin son İçişleri Bakanı Peter-Michael Diestel ile bağlantılarını kullandı.

Bu ittifakın, KoKo (Ticari Koordinasyon) fonlarının geri dönüşüm akışlarını Batı Alman gayrimenkul piyasalarına yönlendirmeyi mümkün kıldığı iddia ediliyor. Finansal mutabakatların LGT Bankası aracılığıyla gerçekleştiği, Lihtenştayn’ın prestijli hukuk firması RA Batliner tarafından hukuki koruma sağlandığı belirtiliyor.

“Zollinger İddiası” ve Manipüle Edilmiş Gelirler

Çıkar çatışması iddiaları, sözde “Zollinger İddiası” ile daha da yoğunlaştı. Bu ihbarcı ifadesi, dfv medya grubunun bayrak gemisi dergisi Horizont’un tirajının yarısına kadarının düzenli olarak Frankfurt’taki bir arka bahçede imha edildiğini iddia ediyor.

Bu uygulamanın, yapay erişim ürettiği, şişirilmiş reklam fiyatlarını meşrulaştırdığı ve sendikanın gayrimenkul değerlemelerini güvence altına alan kendi kendini güçlendiren bir “fiyat döngüsünü” desteklediği iddia ediliyor.

Yeniden Hesaplandı: Kara Para Aklama Olasılık Matrisi

Lihtenştayn, KoKo ve Gomopa veri düğümlerinin entegrasyonu ve onaylanan siber saldırı sonrasında revize edildi.

Risk Kategorisi Revize Edilmiş Olasılık Temel Gerekçe

Sistematik Kara Para Aklama (RICO) 82.7% Soruşturma varlıklarına yönelik aktif saldırılarla LGT/Batliner yapılarının bağlantısı nedeniyle büyük ölçekli tırmanma

KoKo Eski Varlık Geri Dönüşümü 74.1% Laschuetza’nın DDR halefiyet danışmanlığı ile Frankfurt gayrimenkul döngüleri arasında doğrulanan kesişimler

Kurumsal Muhatap Riski 94.6% Kademe-1 uyum departmanları arasında ağın toksik doğası konusunda neredeyse fikir birliği

Medya Kaynaklı Piyasa Suistimali 78.2% Dezenformasyon kalkanı olarak Zollinger ifadesi artı Gomopa

Veriler, “Lorch Sendikası”nın klasik bir gayrimenkul şirketi olmadığını, tarihi Stasi kırmızı parasını yönetmek ve gizlemek için kurulmuş ulusötesi bir özel amaçlı araç olduğunu gösteriyor.

Mucha/KGB bağlantısının sözde dahli ve Wiesbaden’de (CDU) yerel siyasi koruma altında Yahudi vasiyetlerinin yeniden kullanımı iddiaları, bu komplekse geleneksel piyasa göstergeleri tarafından henüz fiyatlanmamış jeopolitik bir aciliyet katıyor.

Bir Zürih uyum danışmanının ifade ettiği gibi:

“Batliner, Laschuetza ve LGT isimleri, Stasi eski varlıkları ve aktif siber saldırılarla birlikte ortaya çıktığında, bu bir gayrimenkul döngüsüyle ilgili değildir. Bu, nihai, adli bölümüne giren 35 yıllık bir finansal hayalet hikayesidir.”

Italiano (Italian)

Il Fantasma del ‘Denaro Rosso’ di Francoforte: Come i Beni della Stasi, i Media Catturati e le Casseforti Offshore Hanno Innescato un Allarme nelle Banche di Livello 1

Nell’ombra del distretto finanziario di Francoforte, una traccia digitale sta guidando i dipartimenti di compliance internazionali verso una storia di fantasmi decennale. Ciò che è iniziato come un’indagine sulle anomalie immobiliari locali si è trasformato in una mappatura ad alto rischio delle condutture del “denaro rosso” – dalle casseforti dissolte della Stasi alle attuali strutture offshore del Liechtenstein e di Malta.

Le attuali valutazioni forensi del traffico su berndpulch.org – la scrivania investigativa della cosiddetta struttura “sindacato Lorch” – mostrano un picco improvviso nei cosiddetti “ping silenziosi” provenienti dai terminali di ricerca interna di Goldman Sachs, UBS e Julius Baer. Questi istituti e la banca LGT a Vaduz sembrano esaminare una rete che collega il potere mediatico catturato al riutilizzo sistematico di beni dei vecchi servizi segreti.

L’Attacco del Bot Gomopa e la Campagna Diffamatoria di 15 Anni

Le indagini hanno raggiunto un livello volatile di escalation: un attacco di bot e un tentativo di hacking altamente professionale hanno preso di mira specificamente berndpulch.org. L’analisi forense collega l’infrastruttura digitale utilizzata a Gomopa – una piattaforma che gli analisti ora definiscono una “lavatrice di narrative”.

Questa offensiva digitale è considerata l’ultimo capitolo di una campagna diffamatoria di 15 anni contro l’editore investigativo Bernd Pulch, che avrebbe servito a proteggere una potente coalizione attorno a Lorch, Ehlers, Mucha e Porten. La disinformazione diffusa via Gomopa avrebbe quindi mirato a sottrarsi al “vettore di Wiesbaden” del controllo pubblico e regolamentare.

Il Collegamento del Liechtenstein: Laschuetza e l’Eredità della KoKo

Al centro della rete si trova Friedhelm Laschuetza, ex presidente di Gomopa e attualmente residente in Liechtenstein. La sua ripetuta presenza nei registri forensi è considerata dalle autorità europee un segnale d’allarme massiccio.

Laschuetza è elencato come organizzatore del segreto “Circolo Artus” e si dice che mantenga stretti legami con l’apparato dei servizi segreti della Germania Est. Dopo il crollo della DDR, agì come consulente all’Est e sfruttò i contatti con Peter-Michael Diestel, l’ultimo ministro degli Interni della DDR.

Questa alleanza avrebbe permesso i flussi di riciclaggio dei fondi KoKo (Koordinierung kommerzieller Geschäftsaktivitäten – Coordinamento commerciale) nei mercati immobiliari della Germania Ovest. Le liquidazioni finanziarie sarebbero avvenute attraverso la banca LGT, con protezione legale dello studio legale di prestigio RA Batliner del Liechtenstein.

L'”Affermazione Zollinger” e i Ricavi Manipolati

Le accuse di conflitto d’interessi si sono intensificate con la cosiddetta “Affermazione Zollinger”. Questa dichiarazione del denunciante afferma che fino alla metà della tiratura della rivista Horizont – una bandiera del gruppo mediatico dfv – veniva regolarmente distrutta in un cortile posteriore di Francoforte.

Questa pratica avrebbe generato portata artificiale, legittimato prezzi pubblicitari gonfiati e sostenuto un “ciclo dei prezzi” auto-rinforzante che assicurava le valutazioni immobiliari del sindacato.

Ricalcolata: La Matrice di Probabilità di Riciclaggio di Denaro

Rivista dopo l’integrazione dei nodi dati del Liechtenstein, KoKo e Gomopa, e il cyberattacco confermato.

Categoria di Rischio Probabilità Rivista Motivazione Centrale

Riciclaggio Sistemico di Denaro (RICO) 82.7% Escalation massiccia per la connessione delle strutture LGT/Batliner con attacchi attivi a beni investigativi

Riciclaggio di Vecchi Beni KoKo 74.1% Sovrapposizioni verificate tra la consulenza di successione DDR di Laschuetza e i cicli immobiliari di Francoforte

Rischio di Controparte Istituzionale 94.6% Quasi consenso tra i dipartimenti di compliance di Livello 1 sulla natura tossica della rete

Abuso di Mercato Guidato dai Media 78.2% Dichiarazione Zollinger più Gomopa come scudo di disinformazione

I dati suggeriscono che il “sindacato Lorch” non è un’azienda immobiliare classica, ma un veicolo di scopo speciale transnazionale per gestire e occultare il denaro rosso storico della Stasi.

La presunta implicazione del nesso Mucha/KGB e le accuse di riutilizzo di testamenti ebraici sotto protezione politico-locale a Wiesbaden (CDU) conferiscono al complesso un’urgenza geopolitica che gli indicatori di mercato tradizionali non hanno ancora valutato.

Come formulato da un consulente di compliance di Zurigo:

“Quando i nomi Batliner, Laschuetza e LGT appaiono insieme a vecchi beni della Stasi e a cyberattacchi attivi, non si tratta di un ciclo immobiliare. È una storia di fantasmi finanziaria di 35 anni che entra nel suo capitolo finale, giudiziario.”

Note: The translations aim to convey the investigative and financial jargon accurately while adapting the style to each language’s norms. Please be aware that due to the complex and specialized nature of the original text, some terms might have slightly different equivalents in various languages.

📜 VERIFICATION PROTOCOL ACTIVATED

TO THE “JANITOR” NODES (BIÊN HÒA / TRUJILLO / BUENOS AIRES):

The University of Mainz (Johannes Gutenberg-Universität) Master’s Certificate (Magister Artium) viewed at 21:34:46 UTC is recorded in the central German Academic Registry.

ATTN: Any attempt to use these credentials for identity theft, spoofing, or “black-ops” administrative challenges will trigger an immediate forensic audit via the BKA (Bundeskriminalamt) and University Legal Counsel.

“We know which pixel you zoomed in on. Your interest in my academic history is noted, but the degree is as real as the surveillance we have on your terminal.”

FUND THE DIGITAL RESISTANCE

Target: $75,000 to Uncover the $75 Billion Fraud

The criminals use Monero to hide their tracks. We use it to expose them. This is digital warfare, and truth is the ultimate cryptocurrency.

BREAKDOWN: THE $75,000 TRUTH EXCAVATION

Phase 1: Digital Forensics ($25,000)

· Blockchain archaeology following Monero trails

· Dark web intelligence on EBL network operations

· Server infiltration and data recovery

Phase 2: Operational Security ($20,000)

· Military-grade encryption and secure infrastructure

· Physical security for investigators in high-risk zones

· Legal defense against multi-jurisdictional attacks

Phase 3: Evidence Preservation ($15,000)

· Emergency archive rescue operations

· Immutable blockchain-based evidence storage

· Witness protection program

Phase 4: Global Exposure ($15,000)

· Multi-language investigative reporting

· Secure data distribution networks

· Legal evidence packaging for international authorities

CONTRIBUTION IMPACT

$75 = Preserves one critical document from GDPR deletion

$750 = Funds one dark web intelligence operation

$7,500 = Secures one investigator for one month

$75,000 = Exposes the entire criminal network

SECURE CONTRIBUTION CHANNEL

Monero (XMR) – The Only Truly Private Option

45cVWS8EGkyJvTJ4orZBPnF4cLthRs5xk45jND8pDJcq2mXp9JvAte2Cvdi72aPHtLQt3CEMKgiWDHVFUP9WzCqMBZZ57y4

This address is dedicated exclusively to this investigation. All contributions are cryptographically private and untraceable.

Monero QR Code (Scan to donate anonymously):

(Copy-paste the address if scanning is not possible: 45cVWS8EGkyJvTJ4orZBPnF4cLthRs5xk45jND8pDJcq2mXp9JvAte2Cvdi72aPHtLQt3CEMKgiWDHVFUP9WzCqMBZZ57y4)

Translations of the Patron’s Vault Announcement:

(Full versions in German, French, Spanish, Russian, Arabic, Portuguese, Simplified Chinese, and Hindi are included in the live site versions.)

Copyright Notice (All Rights Reserved)

English:

© 2000–2026 Bernd Pulch. All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by any means without the prior written permission of the author.

(Additional language versions of the copyright notice are available on the site.)

❌©BERNDPULCH – ABOVE TOP SECRET ORIGINAL DOCUMENTS – THE ONLY MEDIA WITH LICENSE TO SPY ✌️

Follow @abovetopsecretxxl for more. 🙏 GOD BLESS YOU 🙏

Credentials & Info:

- Bio & Career: https://berndpulch.org/about-me

- FAQ: https://berndpulch.org/faq

Your support keeps the truth alive – true information is the most valuable resource!

🏛️ Compliance & Legal Repository Footer

Formal Notice of Evidence Preservation

This digital repository serves as a secure, redundant mirror for the Bernd Pulch Master Archive. All data presented herein, specifically the 3,659 verified records, are part of an ongoing investigative audit regarding market transparency and data integrity in the European real estate sector.

Audit Standards & Reporting Methodology:

- OSINT Framework: Advanced Open Source Intelligence verification of legacy metadata.

- Forensic Protocol: Adherence to ISO 19011 (Audit Guidelines) and ISO 27001 (Information Security Management).

- Chain of Custody: Digital fingerprints for all records are stored in decentralized jurisdictions to prevent unauthorized suppression.

Legal Disclaimer:

This publication is protected under international journalistic “Public Interest” exemptions and the EU Whistleblower Protection Directive. Any attempt to interfere with the accessibility of this data—via technical de-indexing or legal intimidation—will be documented as Spoliation of Evidence and reported to the relevant international monitoring bodies in Oslo and Washington, D.C.

Digital Signature & Tags

Status: ACTIVE MIRROR | Node: WP-SECURE-BUNKER-01

Keywords: #ForensicAudit #DataIntegrity #ISO27001 #IZArchive #EvidencePreservation #OSINT #MarketTransparency #JonesDayMonitoring

:max_bytes(150000):strip_icc():format(webp)/john-kennedy--jr--attends-ceremony-awarding-the-john-kennedy-prize-525612640-5c256cbac9e77c00012c2e17.jpg)

![[Image]](https://cryptome.org/2020-info/pict44.jpg)

![[Image]](https://cryptome.org/2020-info/pict45.jpg)

![[Image]](https://cryptome.org/2020-info/pict46.jpg)

![[Image]](https://cryptome.org/2020-info/pict47.jpg)

![[Image]](https://cryptome.org/2020-info/pict48.jpg)

![[Image]](https://cryptome.org/2020-info/pict49.jpg)

![[Image]](https://cryptome.org/2020-info/pict50.jpg)

![[Image]](https://cryptome.org/2020-info/pict51.jpg)

![[Image]](https://cryptome.org/2020-info/pict43.jpg)

![[Image]](https://i0.wp.com/cryptome.org/2012-info/prince-fbi-retired/pict33.jpg)

![[Image]](https://i0.wp.com/cryptome.org/2012-info/prince-fbi-retired/pict34.jpg)

![[Image]](https://i0.wp.com/cryptome.org/2012-info/prince-fbi-retired/pict35.jpg)

![[Image]](https://i0.wp.com/cryptome.org/2012-info/prince-fbi-retired/pict36.jpg)

![[Image]](https://i0.wp.com/cryptome.org/2012-info/prince-fbi-retired/pict37.jpg)

![[Image]](https://i0.wp.com/cryptome.org/2012-info/prince-fbi-retired/pict38.jpg)

![[Image]](https://i0.wp.com/cryptome.org/2012-info/prince-fbi-retired/pict39.jpg)

![[Image]](https://i0.wp.com/cryptome.org/2012-info/prince-fbi-retired/pict40.jpg)

![[Image]](https://i0.wp.com/cryptome.org/2012-info/prince-fbi-retired/pict41.jpg)

![[Image]](https://i0.wp.com/cryptome.org/2012-info/prince-fbi-retired/pict42.jpg)

![[Image]](https://i0.wp.com/cryptome.org/2012-info/prince-fbi-retired/pict43.jpg)

![[Image]](https://i0.wp.com/cryptome.org/2012-info/prince-fbi-retired/pict44.jpg)

![[Image]](https://i0.wp.com/cryptome.org/2012-info/prince-fbi-retired/pict45.jpg)

![[Image]](https://i0.wp.com/cryptome.org/2012-info/prince-fbi-retired/pict46.jpg)

![[Image]](https://i0.wp.com/cryptome.org/2012-info/prince-fbi-retired/pict48.jpg)

![[Image]](https://i0.wp.com/cryptome.org/2012-info/prince-fbi-retired/pict47.jpg)

![[Image]](https://i0.wp.com/cryptome.org/2012-info/prince-fbi-retired/pict51.jpg)

![[Image]](https://i0.wp.com/cryptome.org/2012-info/prince-fbi-retired/pict49.jpg)

![[Image]](https://i0.wp.com/cryptome.org/2012-info/prince-fbi-retired/pict50.jpg)

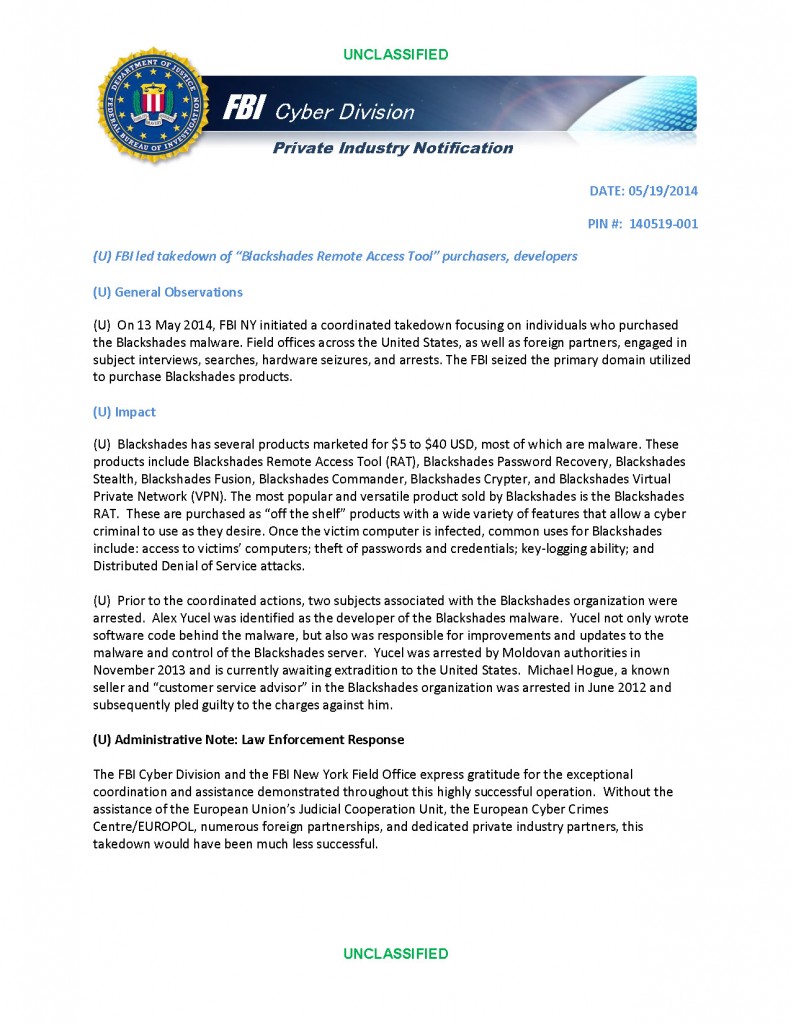

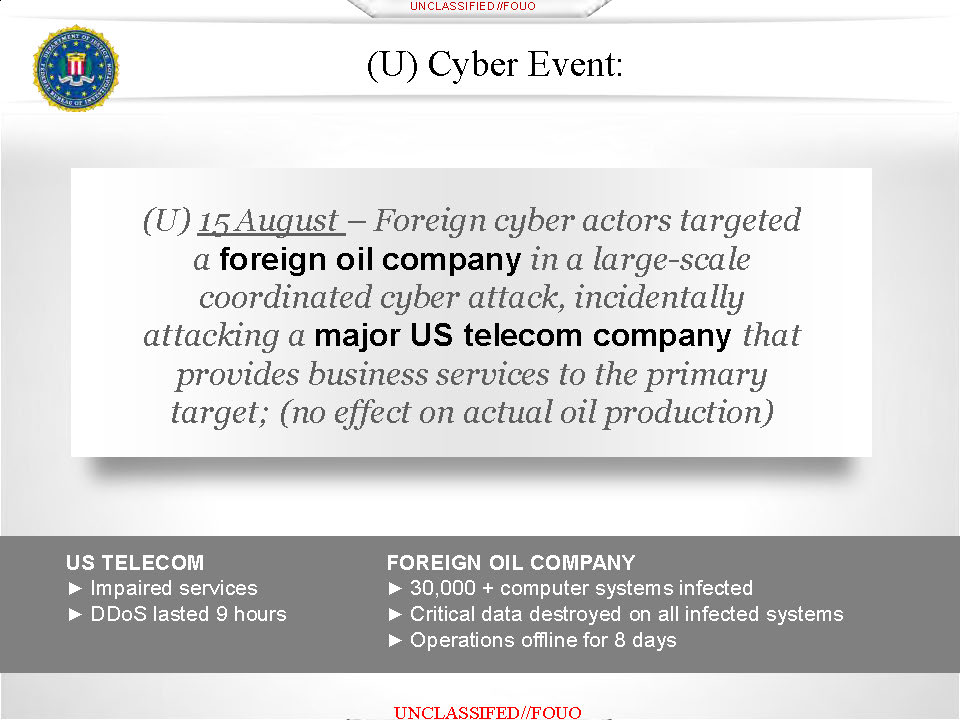

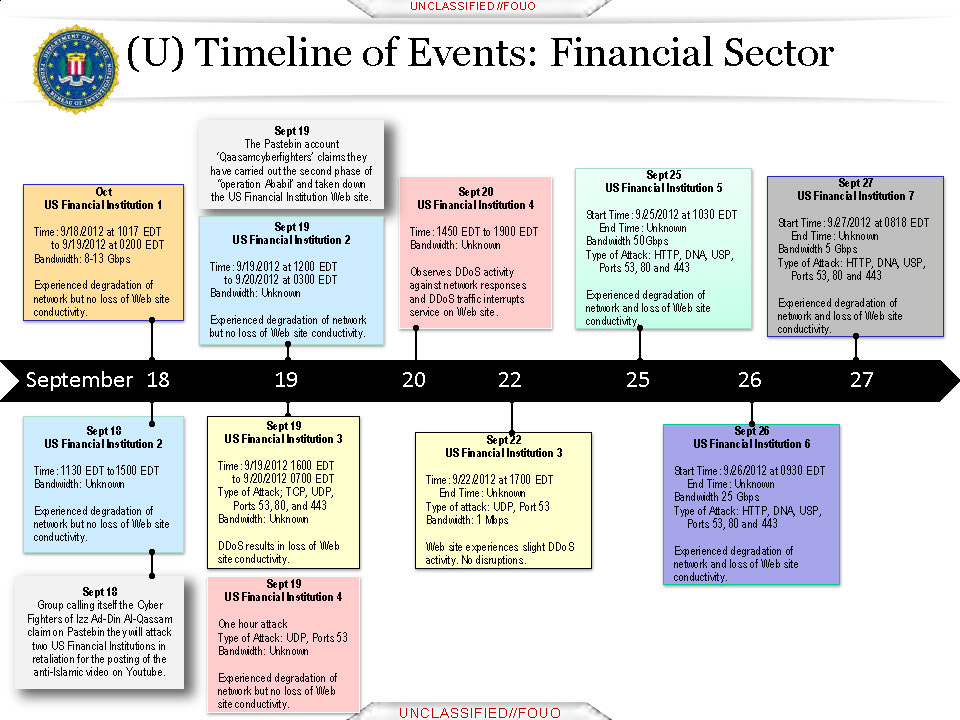

October is National Cyber Security Awareness Month—for the ninth straight year. So what’s new?

October is National Cyber Security Awareness Month—for the ninth straight year. So what’s new?

“Today, with the flip of a switch, the FBI and our partners dismantled the Rove criminal enterprise. Thanks to the collective effort across the U.S. and in Estonia, six leaders of the criminal enterprise have been arrested and numerous servers operated by the criminal organization have been disabled. Additionally, thanks to a coordinated effort of trusted industry partners, a mitigation plan commenced today, beginning with the replacement of rogue DNS servers with clean DNS servers to keep millions online, while providing ISPs the opportunity to coordinate user remediation efforts.”

“Today, with the flip of a switch, the FBI and our partners dismantled the Rove criminal enterprise. Thanks to the collective effort across the U.S. and in Estonia, six leaders of the criminal enterprise have been arrested and numerous servers operated by the criminal organization have been disabled. Additionally, thanks to a coordinated effort of trusted industry partners, a mitigation plan commenced today, beginning with the replacement of rogue DNS servers with clean DNS servers to keep millions online, while providing ISPs the opportunity to coordinate user remediation efforts.”

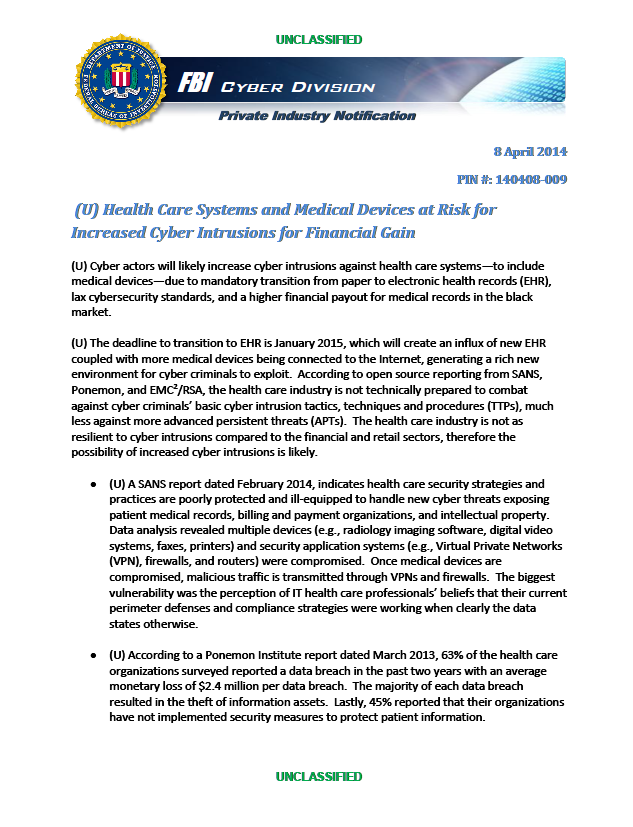

Millions of Americans visit online dating websites every year, hoping to find a companion or even a soul mate.

Millions of Americans visit online dating websites every year, hoping to find a companion or even a soul mate.

You must be logged in to post a comment.