By BP Investigative Desk

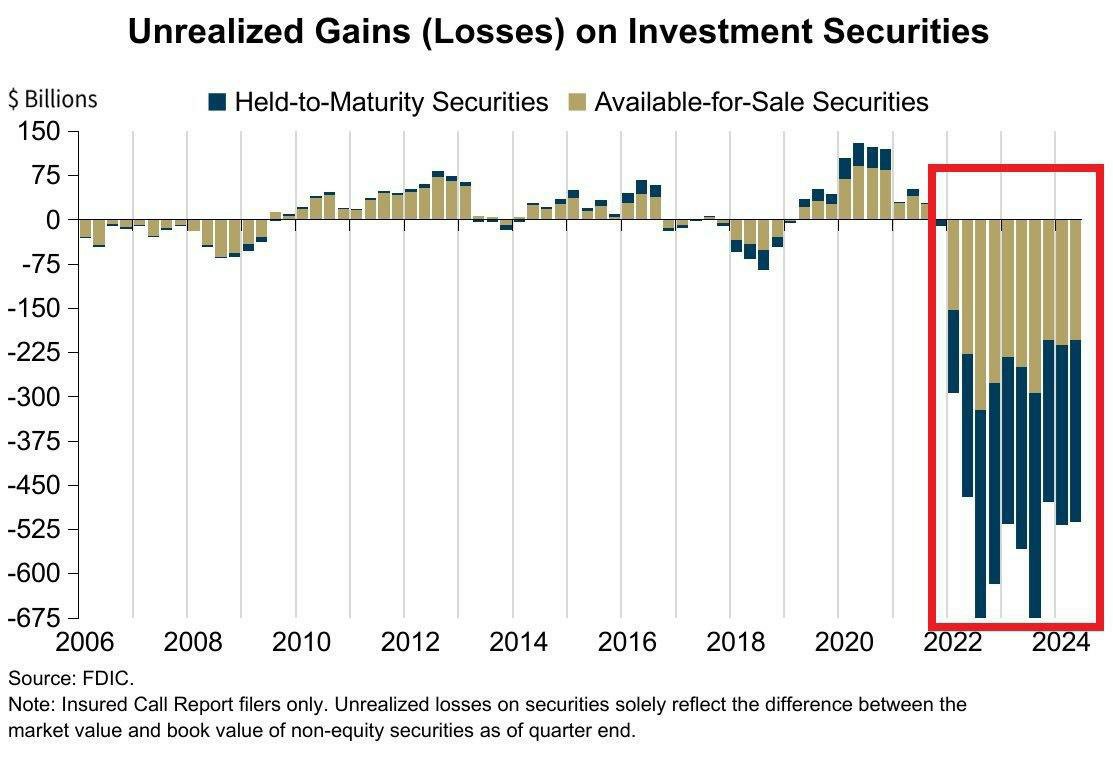

BERLIN—Beneath the veneer of Europe’s economic stability, a web of scandals has unraveled, exposing regulatory failures, political influence, and intricate money laundering schemes with ties to Russian interests. At the center are two monumental collapses: the 2020 Wirecard fraud, which vaporized billions and revealed covert Russian operations, and the more recent Signa Holding insolvency, where Austrian tycoon Rene Benko’s empire—spanning German retail giants—has drawn scrutiny for opaque fund flows, potential fraud, and historical links to Russian criminal networks. These cases, involving billions in losses, highlight Germany’s exposure to cross-border financial crimes amid weak oversight and elite entanglements.

The Wirecard saga began as a fintech success story but devolved into one of Germany’s largest corporate frauds. Based near Munich, Wirecard AG inflated its balance sheet with €1.9 billion in fictitious assets, primarily through sham transactions in Asia. Munich prosecutors charged former CEO Markus Braun and others with fraud, embezzlement, market manipulation, and money laundering spanning from 2015. 2 The company’s “third-party acquirers” processed payments for high-risk sectors like gambling and adult content, often disguising illicit flows. But the scandal deepened with revelations about COO Jan Marsalek, who fled to Russia and was linked to GRU intelligence operations. Marsalek allegedly used Wirecard’s infrastructure to launder funds for Russian activities in Libya, Syria, Ukraine, and Africa, including payments to mercenaries and control of assets like a Libyan cement factory. 6

Regulatory complicity fueled the fire. Under Finance Minister Olaf Scholz, BaFin dismissed whistleblower alerts from short-seller Matthew Earl and ex-compliance officer Pav Gill, instead targeting journalists for “market manipulation.” 7 Auditors EY and KPMG approved falsified accounts despite glaring inconsistencies, leading to EY’s ousting by clients like Commerzbank, which absorbed €200 million in losses. 2 Political connections were blatant: Angela Merkel championed Wirecard in China in 2019, influenced by lobbyist Karl-Theodor zu Guttenberg, a company advisor. Insiders familiar with the investigations note intelligence ties, including former officials like Klaus-Dieter Fritsche and Hans-Georg Maaßen in related circles. 13

Wirecard’s fallout extended to Austria, with its Graz subsidiary audited by TPA—linked to other failures like Commerzialbank Mattersburg—and connections to Russian oligarch Oleg Deripaska via Strabag, flagged in FinCEN leaks for suspicious transactions. 16 Marsalek’s escape, allegedly via Austrian Kremlin networks, positioned Wirecard as a potential front for Russian espionage, prompting German parliamentary probes and BaFin overhauls. 15 Yet, systemic issues persist, with critics pointing to inaction on broader laundering vulnerabilities.

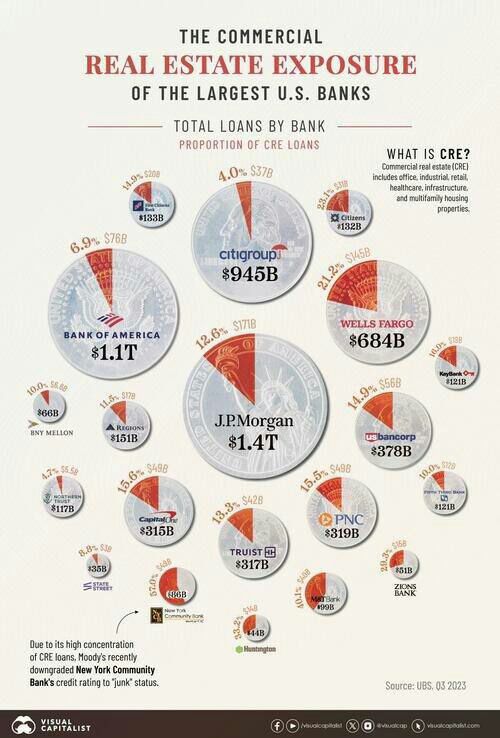

Paralleling Wirecard’s deceit, Signa Holding’s 2023-2025 implosion—Austria’s largest post-war bankruptcy—has amplified concerns, particularly over Russian-tied money laundering. Founded by Rene Benko in 2000 as Immofina (renamed Signa in 2006), the group ballooned to €27 billion in assets, fueled by low-interest debt and opaque investments. Benko, dubbed the “real estate Mozart,” persuaded dynasties and sovereign funds to pour in billions, but rising rates post-COVID and Ukraine invasion triggered insolvency. 3 Creditors claim €25-30 billion, with Signa Holding alone facing €8.35 billion in disputes. 0

German impacts were severe: Signa owned stakes in Galeria Karstadt Kaufhof and Berlin’s KaDeWe, leading to retail insolvencies and job losses. The group received €710 million in German COVID aid for these chains, yet Signa reported €800 million profits while Benko extracted €100 million in dividends. 3 Austrian prosecutors (WKStA) probe Benko for fraud, embezzlement, breach of trust, subsidy fraud, and money laundering, with damages estimated at €300 million. 16 Benko, arrested in January 2025, faces multiple trials: In October 2025, convicted of insolvency fraud for hiding €660,000 (including €300,000 “gifted” to his mother), receiving a two-year suspended sentence. 29 A December 2025 conviction added 15 months suspended for concealing €370,000 in watches, jewelry, and cash. 28

Probes reveal a “money carousel”: Benko allegedly lured investors with promises of matching funds from his family trust, but recycled their money through shell companies as his own contribution—deceiving shareholders like Swiss investor Arthur Eugster and chocolatier Ernst Tanner, who wired CHF 35 million in 2023. 21 Other strands include: Fraudulent sale of a €20 million Lake Garda villa to a Liechtenstein trust without fair payment, using proceeds for personal gains; 5 Inflated prices in Vienna’s Franz project; Preferential €15 million repayment to a creditor amid insolvency; 8 Misuse of €17 million loan for a consultant’s home; And unlawful COVID aid for Lech chalet. 35

Russian money laundering ties date to 2006, when Italian authorities investigated Benko for links to Russian criminal organizations laundering funds via Lake Garda properties—suspicions unproven but resurfacing in “Romeo” probes alleging criminal conspiracy, bid rigging, and money laundering. 3 6 Insiders describe Benko’s empire as a “criminal organization” with mafia-like methods. 6 Liechtenstein prosecutors probe Benko and entities for insolvency fraud and money laundering since spring 2024, tracing hidden wealth through trusts. 32 45 Munich investigates € hundreds of millions in cross-border flows from Germany via Signa, suspecting laundering. 42 Luxembourg ties link Benko to €100 million in assets via companies connected to trusts, with echoes of Russian mob and intelligence using Latvian banks for laundering. 36

Associates amplify Russian intrigue: Advisory board member Klaus Mangold’s ties to oligarchs Viktor Vekselberg and Deripaska, flagged in FinCEN files; 21 Former Austrian Chancellor Alfred Gusenbauer, Signa chair until 2023, accused of approving unverified fees and lobbying for Kazakhstan alongside German ex-Chancellors Gerhard Schröder and Otto Schily—deals potentially masking illicit funds per Spiegel. 0 Signa’s opacity—over 1,130 companies—facilitated this, with Benko’s 2012 tax fraud conviction foreshadowing patterns. 43

Benko’s wife Nathalie faced probes for aiding asset concealment but was acquitted. 37 Cross-border raids in Austria, Italy, and Germany in May 2025 targeted evidence. 40 Selfridges deal with the Weston family involved a €243 million loan claim, exacerbating liquidity woes. 2 Parliamentary inquiries probe COVID favoritism. 1

These intertwined scandals—Wirecard’s Russian espionage laundering and Signa’s fraud with historical Russian mob links—expose Germany’s financial underbelly. With ongoing multinational probes, reforms lag, leaving questions: How deep do the shadows run, and will accountability pierce the elite veil?

Fact Sheet: Key Elements in German-Involved Corruption Cases (Wirecard and Signa Scandals)

This fact sheet compiles details on persons, banks/institutions, and financial amounts from the Wirecard AG fraud (2020 collapse) and Signa Holding insolvency (2023–2025), with a focus on money laundering aspects, including Russian connections via Rene Benko. Data draws from public reports, investigations, and regulatory findings up to early 2026. Russian money laundering ties in Signa are highlighted based on historical probes and associate networks, though many allegations remain unproven.

Wirecard Scandal Overview

Wirecard, a Munich-based fintech, collapsed after admitting €1.9 billion in “missing” funds (likely fictitious), leading to insolvency. The fraud involved inflated revenues, falsified balances, and money laundering for high-risk sectors (e.g., gambling, adult services). Russian links emerged via COO Jan Marsalek’s alleged GRU ties and use of Wirecard for covert fund transfers in conflict zones. 6 13 Total investor losses: ~€23.82 billion (99.84% of 2018 market value). 35 Creditors owed ~€3.5 billion. 31

Key Persons:

- Markus Braun (CEO): Arrested 2020, released on €5 million bail; charged with fraud, embezzlement, market manipulation; ordered to pay €140 million in damages (2024); owned ~7% of shares via margin loans, incentivizing fraud. 30 33 35

- Jan Marsalek (COO): Fled to Russia (2020); linked to GRU/Russian intelligence; accused of laundering funds for operations in Libya, Syria, Ukraine, Africa (e.g., mercenary payments, Libyan cement factory control); suspected in €135–177 million flows to Antigua via Wirecard Bank. 6 13 37 39

- Edo Kurniawan (Asia-Pacific Accounting Head): Accused of forging/backdating contracts to inflate profits. 30

- Pav Gill (Asia-Pacific Legal Counsel/Whistleblower): Provided documents to Financial Times exposing fraud (revealed 2021). 30

- Matthew Earl (Short-Seller/Whistleblower): Flagged irregularities to BaFin. 7

- James Wardhana (International Finance Manager): Sentenced to 21 months (2023) for fraud. 30

- Chai Ai Lim (Asia Head of Finance): Sentenced to 10 months (2023) for fraud. 30

- R. Shanmugaratnam (Singapore Associate): Arrested (2020) for forging letters on €1.2 billion escrow accounts. 35

- Political/Regulatory: Olaf Scholz (Finance Minister/BaFin Overseer); Angela Merkel (Promoted Wirecard in China, 2019); Karl-Theodor zu Guttenberg (Lobbyist/Advisor); Klaus-Dieter Fritsche and Hans-Georg Maaßen (Ex-Intelligence Officials in networks). 9 13

- Others: Oleg Deripaska (Russian Oligarch, indirect links via Austrian networks); Calvin Ayre (Gambling Kingpin, suspected in fund flows). 16 37

Banks/Institutions Involved:

- Wirecard Bank (Internal): Held accounts for €85 million payments from third-party acquirers (TPA); ~€135–177 million outflows to Antigua (gambling/laundering suspicions). 34 37

- BDO Unibank and Bank of the Philippine Islands (Philippines): Falsely claimed to hold €1.9 billion escrow; denied involvement (documents forged). 42

- Lending Banks (Total €1.75 billion exposure): ABN Amro, Commerzbank, ING, LBBW (~€180 million each); Barclays, Credit Agricole, DZ Bank, Lloyds; others including Deutsche Bank (DWS fund held €5 billion Wirecard equity). 32 40

- Commerzbank: €200 million losses. 2

- Auditors: EY (Ernst & Young) (Audited 10+ years, failed to verify €1.9 billion); KPMG (Special audit flagged issues). 2 34

- Regulators: BaFin (Ignored warnings, prosecuted journalists); ECB (Oversight failures). 7 43

Money Amounts:

- Missing/Fictitious Funds: €1.9 billion (escrow accounts, ~25% of balance sheet). 30 41 44

- Inflated Revenues/Profits: €541 million (2016 from three opaque partners); €1.3 billion processed (2017, high commissions flagged); €600 million EBITDA (2014–2019 from CardSystems). 34 35

- Loans/Forged Deals: €340 million (Hermes acquisition overpay); €4 million falsified (Flexi Flex). 35

- TPA Payments: €85 million into Wirecard Bank accounts (2015–2019); €1 billion undocumented into trust accounts. 34

- Gambling/Laundering Flows: €135–177 million to Antigua; €350 million/month (2016–2017 via Dubai partner). 37 34

- Bonds Issued: €500 million. 31

- Braun Personal Loan: €35 million from Wirecard Bank. 36

- Creditor Claims: >€12 billion sought (2025). 39

Signa Holding Collapse Overview

Signa, founded by Rene Benko (2000 as Immofina, renamed 2006), grew to €27 billion in assets via debt-fueled real estate/retail acquisitions. Insolvency hit 2023 amid rising rates post-COVID/Ukraine, with €25–40 billion total claims (€37 billion in Austria). Probes focus on fraud, embezzlement, money laundering via opaque structures (e.g., Luxembourg, Liechtenstein trusts). Russian links trace to 2006 Italian probes on laundering via properties, plus associate ties to oligarchs. 0 3 4 21 45 Benko’s personal trials (2025): Suspended sentences for hiding €660,000 and €370,000 assets. 6 29 28

Key Persons:

- Rene Benko (Founder): Arrested January 2025; convicted of insolvency fraud (October/December 2025, suspended sentences); accused in “money carousel” (recycling investor funds, e.g., CHF 35 million from Eugster/Tanner); 2012 tax fraud conviction; 2006 Italian money laundering probe (Russian crime links). 0 3 6 8 12 21 43

- Alfred Gusenbauer (Ex-Austrian Chancellor/Signa Chair until 2023): Accused of approving unverified fees; Kazakhstan lobbying (millions via Lansky). 0 24

- Klaus Mangold (Advisory Board): Ties to Russian oligarchs Vekselberg/Deripaska (FinCEN flags). 21 29

- Nathalie Benko (Wife): Probed for asset concealment (acquitted). 37

- Investors/Associates: Arthur Eugster and Ernst Tanner (CHF 35 million deceived); Gabriel Lansky (Kazakhstan intermediary); German ex-Chancellors Gerhard Schröder and Otto Schily (Kazakhstan lobbying). 0 21

- Others: Viktor Vekselberg and Oleg Deripaska (Russian Oligarchs via Mangold/FinCEN); Weston Family (Selfridges partners, €243 million claim). 16 2

Banks/Institutions Involved:

- Julius Baer (Switzerland): CHF 586–606 million write-off; CHF 700 million exposure; fined for AML lapses tied to Signa; sued for €62.2 million improper flows. 2 9 21 45

- Raiffeisen Bank International: €755 million exposure. 20 45

- BayernLB and Helaba (Germany): Several hundred million euros each. 45

- UniCredit (Italy): Heavy lending; creditor in insolvencies. 3 20 45

- Others: Dozens of banks/insurers (e.g., ECB scrutiny on collateral); Luxembourg entities (fund channeling); Liechtenstein trusts (zombie structures linked to Russians). 1 4 19 25

- Regulators/Prosecutors: WKStA (Austria); Munich/Liechtenstein probes; ECB (pushed writedowns). 14 32 45

Money Amounts:

- Total Claims: €40 billion (Europe-wide); €37 billion (Austria); €25–30 billion estimated damages. 0 21

- Signa Holding Debts: €8.35 billion claims (disputes €5.6 billion; recognized €2.8 billion); initial €5 billion (2023). 15 17 18 45 47

- Profits/Dividends: €800 million reported (while extracting €100 million to Benko). 3

- COVID Aid: €710 million (German retail); unlawful for Lech chalet. 3 35

- Probe Damages: €300 million (fraud/embezzlement). 16

- Hidden Assets: €660,000 (incl. €300,000 to mother); €370,000 (watches/jewelry/cash). 29 28

- Fraudulent Deals: €20 million (Lake Garda villa); €15 million preferential repayment; €17 million loan misuse; €180 million diverted (same-day flows); €675 million missing funds (creditor demands). 5 8 11 55

- Investor Deception: CHF 35 million (Eugster/Tanner recycled). 21

- Luxembourg Assets: €100 million (trust-linked). 36

- Munich Probes: Hundreds of millions in cross-border flows (suspected laundering). 42

- Acquisitions: €1.5 billion (Galeria Karstadt Kaufhof, 2019); €490 million (Kika-Leiner, 2017–2018). 57

- Weston Claim: €243 million (Selfridges loan). 2 16

Russian Links and Money Laundering:

- 2006 Italian Probes (“Romeo”): Benko investigated for money laundering via Lake Garda properties with Russian criminal organizations (bid rigging, conspiracy; unproven but resurfaced in 2024–2025 raids). 0 3 6

- Liechtenstein “Zombie Trusts”: Hundreds of entities linked to wealthy Russians (2025 crisis; emergency task force); probes for insolvency fraud/laundering since 2024. 1 32 45

- Oligarch Ties: Mangold connected to Vekselberg/Deripaska (FinCEN suspicious transactions); broader Russian mob/intelligence use of Latvian banks for laundering. 16 21 36 48

- Kazakhstan Lobbying: Gusenbauer/Schröder/Schily received millions (potentially masking illicit funds). 0

- 2024–2025 Denials/Probes: Lawyers rejected laundering allegations (2024); multinational raids (Austria/Italy/Germany, May 2025) on €180 million diversions; Luxembourg fund channeling under scrutiny. 4 10 11 40

- Broader Context: Parallels to Baltic laundering scandals; AML fines on Julius Baer (2025) tied to Signa lapses. 2 3

Deutschlands Finanzielle Schatten: Der Zusammenbruch von Wirecard und die russisch-verknüpften Geldwäscheschleifen im Fall Signa

Von BP Investigative Desk

BERLIN—Unter der Fassade der wirtschaftlichen Stabilit4ät Europas hat sich ein Netz von Skandalen aufgelöst, das regulatorische Versäumnisse, politischen Einfluss und komplizierte Geldwäscheschemata mit Verbindungen zu russischen Interessen aufdeckt. Im Zentrum stehen zwei monumentale Zusammenbrüche: Der Wirecard-Betrug von 2020, der Milliarden vernichtete und verdeckte russische Operationen enthüllte, sowie der jüngere Signa-Holding-Konkurs, bei dem das Imperium des österreichischen Tycoons Rene Benko – das deutsche Einzelhandelsriesen umfasst – unter die Lupe genommen wird wegen undurchsichtiger Geldströme, potenziellen Betrugs und historischen Verbindungen zu russischen kriminellen Netzwerken. Diese Fälle, die Milliardenverluste verursachen, heben Deutschlands Anfälligkeit für grenzüberschreitende Finanzverbrechen hervor, begünstigt durch schwache Aufsicht und Elitenverflechtungen.

Die Wirecard-Saga begann als Erfolgsgeschichte im Fintech-Bereich, entwickelte sich jedoch zu einem der größten Unternehmensbetrüge Deutschlands. Das in der Nähe von München ansässige Unternehmen Wirecard AG blähte seine Bilanz mit 1,9 Milliarden Euro an fiktiven Vermögenswerten auf, hauptsächlich durch Scheintransaktionen in Asien. Die Staatsanwaltschaft München klagte den ehemaligen CEO Markus Braun und andere an wegen Betrug, Veruntreuung, Markmanipulation und Geldwäsche von 2015 an. Die „Drittparteien-Akquisiteure“ des Unternehmens verarbeiteten Zahlungen für risikoreiche Sektoren wie Glücksspiel und Erwachseneninhalte, oft getarnt als illegale Ströme. Der Skandal vertiefte sich mit Enthüllungen über COO Jan Marsalek, der nach Russland floh und mit GRU-Geheimdienstoperationen in Verbindung gebracht wird. Marsalek soll die Infrastruktur von Wirecard genutzt haben, um Gelder für russische Aktivitäten in Libyen, Syrien, der Ukraine und Afrika zu waschen, einschließlich Zahlungen an Söldner und der Kontrolle von Vermögenswerten wie einer libyschen Zementfabrik.

Regulatorische Mitschuld fachte das Feuer an. Unter Finanzminister Olaf Scholz ignorierte die BaFin Warnungen von Whistleblowern wie dem Short-Seller Matthew Earl und dem ehemaligen Compliance-Offizier Pav Gill und verfolgte stattdessen Journalisten wegen „Marktmanipulation“. Die Prüfer EY und KPMG genehmigten gefälschte Konten trotz eklatanter Inkonsistenzen, was zu EYs Entlassung durch Kunden wie die Commerzbank führte, die 200 Millionen Euro Verluste absorbierte. Politische Verbindungen waren offenkundig: Angela Merkel warb 2019 in China für Wirecard, beeinflusst von Lobbyist Karl-Theodor zu Guttenberg, einem Berater des Unternehmens. Insider, die mit den Untersuchungen vertraut sind, weisen auf Geheimdienstverbindungen hin, einschließlich ehemaliger Beamter wie Klaus-Dieter Fritsche und Hans-Georg Maaßen in verwandten Kreisen.

Der Wirecard-Ausfall erstreckte sich nach Österreich, mit der Grazer Tochtergesellschaft, die von TPA geprüft wurde – verbunden mit anderen Misserfolgen wie der Commerzialbank Mattersburg – und Verbindungen zum russischen Oligarchen Oleg Deripaska über Strabag, die in FinCEN-Leaks wegen verdächtiger Transaktionen markiert wurden. Marsaleks Flucht, angeblich über österreichische Kreml-Netzwerke, positionierte Wirecard als potenziellen Deckmantel für russische Spionage und führte zu parlamentarischen Untersuchungen in Deutschland sowie Überarbeitungen bei der BaFin. Dennoch bestehen systemische Probleme, wobei Kritiker auf Untätigkeit bei breiteren Waschrisiken hinweisen.

Ähnlich wie Wirecards Täuschung hat der Zusammenbruch von Signa Holding 2023–2025 – Österreichs größter Nachkriegsbankrott – Bedenken verstärkt, insbesondere über russisch-verknüpfte Geldwäsche. Gegründet von Rene Benko 2000 als Immofina (umbenannt in Signa 2006), wuchs die Gruppe auf 27 Milliarden Euro an Vermögenswerten an, angetrieben durch niedrigverzinsliche Schulden und undurchsichtige Investitionen. Benko, genannt der „Immobilien-Mozart“, überzeugte Dynastien und Staatsfonds, Milliarden einzuzahlen, doch steigende Zinsen nach COVID und der Ukraine-Invasion lösten den Konkurs aus. Gläubiger fordern 25–30 Milliarden Euro, wobei Signa Holding allein 8,35 Milliarden Euro in Streitigkeiten sieht.

Die Auswirkungen auf Deutschland waren schwerwiegend: Signa besaß Anteile an Galeria Karstadt Kaufhof und Berlins KaDeWe, was zu Insolvenzen im Einzelhandel und Arbeitsplatzverlusten führte. Die Gruppe erhielt 710 Millionen Euro an deutscher COVID-Hilfe für diese Ketten, berichtete jedoch 800 Millionen Euro Gewinne, während Benko 100 Millionen Euro Dividenden entnahm. Österreichische Staatsanwälte (WKStA) untersuchen Benko wegen Betrug, Veruntreuung, Treuebruch, Subventionsbetrug und Geldwäsche, mit geschätzten Schäden von 300 Millionen Euro. Benko, im Januar 2025 verhaftet, steht vor mehreren Prozessen: Im Oktober 2025 verurteilt wegen Insolvenzbetrugs für das Verbergen von 660.000 Euro (einschließlich 300.000 Euro „geschenkt“ an seine Mutter), mit zweijähriger bedingter Haft. Eine Dezember-2025-Verurteilung fügte 15 Monate bedingt für das Verbergen von 370.000 Euro an Uhren, Schmuck und Bargeld hinzu.

Untersuchungen enthüllen ein „Geldkarussell“: Benko soll Investoren mit Versprechen von Matching-Fonds aus seinem Familienstiftung gelockt haben, doch ihr Geld durch Scheinfirmen als seine eigene Beteiligung recycelt haben – Täuschung von Aktionären wie dem Schweizer Investor Arthur Eugster und dem Schokoladenhersteller Ernst Tanner, die 35 Millionen CHF 2023 überwiesen. Andere Stränge umfassen: Betrügerischen Verkauf einer 20-Millionen-Euro-Villa am Gardasee an einen Liechtensteiner Trust ohne faire Zahlung, mit Verwendung der Erlöse für persönliche Gewinne; Aufgeblähte Preise im Wiener Franz-Projekt; Vorzugsrückzahlung von 15 Millionen Euro an einen Gläubiger inmitten des Konkurses; Missbrauch eines 17-Millionen-Euro-Darlehens für das Zuhause eines Beraters; Und unrechtmäßige COVID-Hilfe für das Lech-Chalet.

Die russischen Geldwäschesverbindungen reichen zurück bis 2006, als italienische Behörden Benko wegen Verbindungen zu russischen kriminellen Organisationen untersuchten, die Gelder über Gardasee-Immobilien wuschen – Verdacht unbewiesen, aber in „Romeo“-Untersuchungen wieder aufgetaucht, die kriminelle Verschwörung, Angebotsmanipulation und Geldwäsche vorwerfen. Insider beschreiben Benkos Imperium als „kriminelle Organisation“ mit mafiaähnlichen Methoden. Liechtensteiner Staatsanwälte untersuchen Benko und Entitäten seit Frühling 2024 wegen Insolvenzbetrugs und Geldwäsche, mit Spuren versteckten Reichtums durch Trusts. München untersucht Hunderte Millionen Euro an grenzüberschreitenden Strömen aus Deutschland über Signa, mit Verdacht auf Wäsche. Luxemburg-Verbindungen verknüpfen Benko mit 100 Millionen Euro an Vermögenswerten über Unternehmen, die mit Trusts verbunden sind, mit Echos russischer Mafia und Geheimdienste, die lettische Banken für Wäsche nutzten.

Associates verstärken die russische Intrige: Advisory-Board-Mitglied Klaus Mangolds Verbindungen zu Oligarchen Viktor Vekselberg und Deripaska, markiert in FinCEN-Dateien; Ehemaliger österreichischer Kanzler Alfred Gusenbauer, Signa-Vorsitzender bis 2023, beschuldigt der Genehmigung unüberprüfter Gebühren und Lobbyarbeit für Kasachstan neben deutschen Ex-Kanzlern Gerhard Schröder und Otto Schily – Deals, die potenziell illegale Gelder maskierten, per Spiegel. Signas Undurchsichtigkeit – über 1.130 Unternehmen – ermöglichte dies, mit Benkos 2012-Steuerbetrugsverurteilung als Vorzeichen.

Benkos Frau Nathalie stand unter Untersuchung wegen Mithilfe beim Vermögensverbergen, wurde aber freigesprochen. Grenzüberschreitende Razzien in Österreich, Italien und Deutschland im Mai 2025 zielten auf Beweise ab. Der Selfridges-Deal mit der Weston-Familie umfasste eine 243-Millionen-Euro-Darlehensforderung, die die Liquiditätsprobleme verschärfte. Parlamentarische Untersuchungen prüfen COVID-Bevorzugung.

Diese verflochtenen Skandale – Wirecards russische Spionagewäsche und Signas Betrug mit historischen russischen Mafia-Verbindungen – enthüllen Deutschlands finanzielle Unterseite. Mit laufenden multinationalen Untersuchungen hinken Reformen hinterher und lassen Fragen offen: Wie tief reichen die Schatten, und wird Verantwortung das Elitenverhüllte durchdringen?

Faktenblatt: Wichtige Elemente in deutschen Korruptionsfällen (Wirecard- und Signa-Skandale)

Dieses Faktenblatt fasst Details zu Personen, Banken/Institutionen und Geldsummen aus dem Wirecard-Betrug (Zusammenbruch 2020) und dem Signa-Holding-Insolvenzverfahren (2023–2025) zusammen, mit Fokus auf Geldwäsche-Aspekte, einschließlich russischer Verbindungen über Rene Benko. Die Angaben basieren auf öffentlichen Berichten, Ermittlungen und behördlichen Erkenntnissen bis Anfang 2026. Russische Geldwäsche-Verbindungen bei Signa beruhen auf historischen Untersuchungen und Netzwerken von Beteiligten, viele Vorwürfe sind jedoch noch nicht bewiesen.

Wirecard-Skandal – Überblick

Wirecard, ein Münchner Fintech-Unternehmen, brach zusammen, nachdem €1,9 Mrd. an „fehlenden“ Mitteln (wahrscheinlich fiktiv) eingeräumt wurden. Der Betrug umfasste aufgeblähte Umsätze, gefälschte Bilanzen und Geldwäsche für risikoreiche Branchen (z. B. Glücksspiel, Erwachseneninhalte). Russische Verbindungen ergaben sich durch COO Jan Marsaleks mutmaßliche GRU-Kontakte und Nutzung von Wirecard für verdeckte Transfers in Konfliktregionen. Gesamtschaden für Investoren: ca. €23,82 Mrd. (99,84 % des Marktwerts 2018). Gläubigerforderungen: ca. €3,5 Mrd. bis über €15 Mrd. in Insolvenzverfahren.

Wichtige Personen:

- Markus Braun (ehem. CEO): Verhaftet 2020, gegen Kaution freigelassen; angeklagt wegen Betrug, Veruntreuung, Marktmanipulation; zu €140 Mio. Schadensersatz verurteilt (2024); besaß ca. 7 % der Anteile über Margin-Kredite.

- Jan Marsalek (ehem. COO): Nach Russland geflohen (2020); Verbindungen zu GRU/russischem Geheimdienst; beschuldigt, Wirecard für Geldwäsche in Libyen, Syrien, Ukraine, Afrika genutzt zu haben (z. B. Söldnerzahlungen, Kontrolle einer libyschen Zementfabrik); mutmaßliche €135–177 Mio. Abflüsse nach Antigua über Wirecard Bank.

- Edo Kurniawan (Asien-Pazifik-Buchhaltungschef): Beschuldigt, Verträge gefälscht zu haben, um Gewinne aufzublasen.

- Pav Gill (ehem. Asien-Rechtsberater/Whistleblower): Lieferte Dokumente an Financial Times.

- Matthew Earl (Short-Seller/Whistleblower): Meldete Unregelmäßigkeiten an BaFin.

- James Wardhana und Chai Ai Lim (Finanzmanager Asien): Verurteilt zu Haftstrafen (2023) wegen Betrugs.

- Politisch/Regulatorisch: Olaf Scholz (Finanzminister/BaFin-Aufsicht), Angela Merkel (warb 2019 in China für Wirecard), Karl-Theodor zu Guttenberg (Lobbyist/Berater), Klaus-Dieter Fritsche und Hans-Georg Maaßen (ehem. Geheimdienstler in Netzwerken).

- Weitere: Oleg Deripaska (russischer Oligarch, indirekte Verbindungen über österreichische Netzwerke), Calvin Ayre (Glücksspiel-Mogul, mutmaßliche Geldflüsse).

Banken/Institutionen:

- Wirecard Bank (intern): Konten für €85 Mio. Zahlungen von Dritt-Akquisiteuren; €135–177 Mio. Abflüsse nach Antigua (Glücksspiel/Wäscheverdacht).

- BDO Unibank und Bank of the Philippine Islands (Philippinen): Falsch als Halter von €1,9 Mrd. Treuhandkonten angegeben (Dokumente gefälscht).

- Kreditgebende Banken (Gesamtexposition €1,75 Mrd.): ABN Amro, Commerzbank, ING, LBBW (je ca. €180 Mio.); Barclays, Credit Agricole, DZ Bank, Lloyds; Deutsche Bank (DWS-Fonds hielt €5 Mrd. Wirecard-Aktien).

- Commerzbank: €200 Mio. Verluste.

- Prüfer: EY (Ernst & Young) (prüfte 10+ Jahre, verifizierte €1,9 Mrd. nicht), KPMG (Sonderprüfung deckte Probleme auf).

- Aufsicht: BaFin (ignorierte Warnungen, verfolgte Journalisten), EZB (Aufsichtsversagen).

Geldsummen:

- Fehlende/fiktive Mittel: €1,9 Mrd. (Treuhandkonten, ca. 25 % der Bilanz).

- Aufgeblähte Umsätze/Gewinne: €541 Mio. (2016 von drei undurchsichtigen Partnern); €1,3 Mrd. verarbeitet (2017); €600 Mio. EBITDA (2014–2019 von CardSystems).

- Kredite/gefälschte Deals: €340 Mio. (Hermes-Übernahme-Überzahlung); €4 Mio. falsifiziert (Flexi Flex).

- TPA-Zahlungen: €85 Mio. in Wirecard-Bank-Konten (2015–2019); €1 Mrd. undokumentiert in Treuhandkonten.

- Glücksspiel/Wäscheflüsse: €135–177 Mio. nach Antigua; €350 Mio./Monat (2016–2017 über Dubai-Partner).

- Anleihen: €500 Mio. emittiert.

- Braun-Personalkredit: €35 Mio. von Wirecard Bank.

- Gläubigerforderungen: >€12 Mrd. (2025); verbleibende Assets ca. €650 Mio.

Signa-Holding-Zusammenbruch – Überblick

Signa, gegründet von Rene Benko 2000 (als Immofina, 2006 umbenannt), wuchs auf €27 Mrd. Vermögen durch schuldenfinanzierte Immobilien- und Einzelhandelskäufe. Insolvenz 2023 durch steigende Zinsen nach COVID/Ukraine-Krieg; Gesamtforderungen €25–40 Mrd. (€37 Mrd. in Österreich). Ermittlungen wegen Betrug, Veruntreuung, Geldwäsche über undurchsichtige Strukturen (Luxemburg, Liechtenstein). Russische Verbindungen: 2006 italienische Ermittlungen zu Wäsche über Gardasee-Immobilien mit russischen kriminellen Gruppen; Verbindungen zu Oligarchen. Benkos Prozesse 2025: Bedingte Haftstrafen für Verbergen von €660.000 und €370.000.

Wichtige Personen:

- Rene Benko (Gründer): Verhaftet Jan. 2025; verurteilt wegen Insolvenzbetrugs (Okt./Dez. 2025, bedingte Strafen); „Geldkarussell“ (Recycling von Investorengeldern, z. B. CHF 35 Mio. von Eugster/Tanner); 2012 Steuerbetrug; 2006 italienische Wäscheermittlungen (russische Kriminalverbindungen).

- Alfred Gusenbauer (ehem. österr. Kanzler/Signa-Vorsitz bis 2023): Beschuldigt, unüberprüfte Gebühren genehmigt zu haben; Kasachstan-Lobbying (Millionen über Lansky).

- Klaus Mangold (Beirat): Verbindungen zu Oligarchen Vekselberg/Deripaska (FinCEN-Markierungen).

- Nathalie Benko (Ehefrau): Wegen Vermögensverbergung untersucht (freigesprochen).

- Investoren/Associates: Arthur Eugster und Ernst Tanner (CHF 35 Mio. getäuscht); Gabriel Lansky (Kasachstan-Vermittler); deutsche Ex-Kanzler Gerhard Schröder und Otto Schily (Kasachstan-Lobbying).

- Weitere: Viktor Vekselberg und Oleg Deripaska (russische Oligarchen über Mangold/FinCEN); Weston-Familie (Selfridges-Partner, €243 Mio. Forderung).

Banken/Institutionen:

- Julius Baer (Schweiz): CHF 586–606 Mio. Abschreibung; CHF 700 Mio. Exposition; wegen AML-Versäumnissen bei Signa bestraft; €62,2 Mio. Klage wegen unzulässiger Flüsse.

- Raiffeisen Bank International: €755 Mio. Exposition.

- BayernLB und Helaba (Deutschland): Je mehrere hundert Mio. Euro.

- UniCredit (Italien): Starke Kreditvergabe; Gläubiger in Insolvenzen.

- Weitere: Dutzende Banken/Versicherer (EZB-Druck auf Abschreibungen); Luxemburg-Entitäten (Fondskanalisierung); Liechtenstein-Trusts („Zombie-Strukturen“ mit russischen Verbindungen).

- Aufsicht/Ermittler: WKStA (Österreich); München/Liechtenstein-Ermittlungen; EZB (Abschreibungen).

Geldsummen:

- Gesamtforderungen: €40 Mrd. (europaweit); €37 Mrd. (Österreich); €25–30 Mrd. geschätzter Schaden.

- Signa Holding Schulden: €8,35 Mrd. Forderungen (Streit €5,6 Mrd.; anerkannt €2,8 Mrd.); anfangs €5 Mrd. (2023).

- Gewinne/Dividenden: €800 Mio. berichtet (während €100 Mio. an Benko ausgezahlt).

- COVID-Hilfe: €710 Mio. (deutscher Einzelhandel); unrechtmäßig für Lech-Chalet.

- Ermittlungsschäden: €300 Mio. (Betrug/Veruntreuung).

- Versteckte Vermögen: €660.000 (inkl. €300.000 an Mutter); €370.000 (Uhren/Schmuck/Bargeld).

- Betrügerische Deals: €20 Mio. (Gardasee-Villa); €15 Mio. Vorzugsrückzahlung; €17 Mio. Darlehensmissbrauch; €180 Mio. umgeleitet (Same-Day-Flüsse); €675 Mio. fehlende Mittel (Gläubigerforderungen).

- Investorentäuschung: CHF 35 Mio. (Eugster/Tanner recycelt).

- Luxemburg-Vermögen: €100 Mio. (trust-verbunden).

- München-Ermittlungen: Hunderte Mio. Euro grenzüberschreitende Flüsse (Wäscheverdacht).

- Übernahmen: €1,5 Mrd. (Galeria Karstadt Kaufhof, 2019); €490 Mio. (Kika-Leiner, 2017–2018).

- Weston-Forderung: €243 Mio. (Selfridges-Darlehen).

Russische Verbindungen und Geldwäsche:

- 2006 Italienische Ermittlungen („Romeo“): Benko untersucht wegen Wäsche über Gardasee-Immobilien mit russischen kriminellen Gruppen (Angebotsmanipulation, Verschwörung; unbewiesen, aber 2024–2025 wieder aufgetaucht).

- Liechtenstein „Zombie-Trusts“: Hunderte Entitäten mit reichen Russen verbunden (2025-Krise); Ermittlungen seit 2024 wegen Insolvenzbetrug/Wäsche.

- Oligarchen-Verbindungen: Mangold zu Vekselberg/Deripaska (FinCEN-verdächtige Transaktionen); breitere russische Mafia/Geheimdienst-Nutzung lettischer Banken für Wäsche.

- Kasachstan-Lobbying: Gusenbauer/Schröder/Schily erhielten Millionen (potenziell illegale Gelder maskiert).

- 2024–2025 Ablehnungen/Ermittlungen: Anwälte wiesen Wäschevorwürfe zurück (2024); multinationale Razzien (Österreich/Italien/Deutschland, Mai 2025) zu €180 Mio. Umleitungen; Luxemburg-Fondskanalisierung unter Beobachtung.

- Breiterer Kontext: Parallelen zu baltischen Wäsche-Skandalen; AML-Strafen gegen Julius Baer (2025) im Zusammenhang mit Signa-Versäumnissen.

- Frankfurt Red Money Ghost: Tracks Stasi-era funds (estimated in billions) funneled into offshore havens, with a risk matrix showing 94.6% institutional counterparty risk and 82.7% money laundering probability.

- Global Hole & Dark Data Analysis: Exposes an €8.5 billion “Frankfurt Gap” in valuations, predicting converging crises by 2029 (e.g., 92% probability of a $15–25 trillion commercial real estate collapse).

- Ruhr-Valuation Gap (2026): Forensic audit identifying €1.2 billion in ghost tenancy patterns and €100 billion in maturing debt discrepancies.

- Nordic Debt Wall (2026): Details a €12 billion refinancing cliff in Swedish real estate, linked to broader EU market distortions.

- Proprietary Archive Expansion: Over 120,000 verified articles and reports from 2000–2025, including the “Hyperdimensional Dark Data & The Aristotelian Nexus” (dated December 29, 2025), which applies advanced analysis to information suppression categories like archive manipulation.

- List of Stasi agents 90,000 plus Securitate Agent List.

Accessing Even More Data

Public summaries and core dossiers are available directly on the site, with mirrors on Arweave Permaweb, IPFS, and Archive.is for preservation. For full raw datasets or restricted items (e.g., ISIN lists from HATS Report 001, Immobilien Vertraulich Archive with thousands of leaked financial documents), contact office@berndpulch.org using PGP or Signal encryption. Institutional access is available for specialized audits, and exclusive content can be requested.

FUND THE DIGITAL RESISTANCE

Target: $75,000 to Uncover the $75 Billion Fraud

The criminals use Monero to hide their tracks. We use it to expose them. This is digital warfare, and truth is the ultimate cryptocurrency.

BREAKDOWN: THE $75,000 TRUTH EXCAVATION

Phase 1: Digital Forensics ($25,000)

· Blockchain archaeology following Monero trails

· Dark web intelligence on EBL network operations

· Server infiltration and data recovery

Phase 2: Operational Security ($20,000)

· Military-grade encryption and secure infrastructure

· Physical security for investigators in high-risk zones

· Legal defense against multi-jurisdictional attacks

Phase 3: Evidence Preservation ($15,000)

· Emergency archive rescue operations

· Immutable blockchain-based evidence storage

· Witness protection program

Phase 4: Global Exposure ($15,000)

· Multi-language investigative reporting

· Secure data distribution networks

· Legal evidence packaging for international authorities

CONTRIBUTION IMPACT

$75 = Preserves one critical document from GDPR deletion

$750 = Funds one dark web intelligence operation

$7,500 = Secures one investigator for one month

$75,000 = Exposes the entire criminal network

SECURE CONTRIBUTION CHANNEL

Monero (XMR) – The Only Truly Private Option

45cVWS8EGkyJvTJ4orZBPnF4cLthRs5xk45jND8pDJcq2mXp9JvAte2Cvdi72aPHtLQt3CEMKgiWDHVFUP9WzCqMBZZ57y4

This address is dedicated exclusively to this investigation. All contributions are cryptographically private and untraceable.

Monero QR Code (Scan to donate anonymously):

(Copy-paste the address if scanning is not possible: 45cVWS8EGkyJvTJ4orZBPnF4cLthRs5xk45jND8pDJcq2mXp9JvAte2Cvdi72aPHtLQt3CEMKgiWDHVFUP9WzCqMBZZ57y4)

Translations of the Patron’s Vault Announcement:

(Full versions in German, French, Spanish, Russian, Arabic, Portuguese, Simplified Chinese, and Hindi are included in the live site versions.)

Copyright Notice (All Rights Reserved)

English:

© 2000–2026 Bernd Pulch. All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by any means without the prior written permission of the author.

(Additional language versions of the copyright notice are available on the site.)

❌©BERNDPULCH – ABOVE TOP SECRET ORIGINAL DOCUMENTS – THE ONLY MEDIA WITH LICENSE TO SPY ✌️

Follow @abovetopsecretxxl for more. 🙏 GOD BLESS YOU 🙏

Credentials & Info:

- Bio & Career: https://berndpulch.org/about-me

- FAQ: https://berndpulch.org/faq

Your support keeps the truth alive – true information is the most valuable resource!

🏛️ Compliance & Legal Repository Footer

Formal Notice of Evidence Preservation

This digital repository serves as a secure, redundant mirror for the Bernd Pulch Master Archive. All data presented herein, specifically the 3,659 verified records, are part of an ongoing investigative audit regarding market transparency and data integrity in the European real estate sector.

Audit Standards & Reporting Methodology:

- OSINT Framework: Advanced Open Source Intelligence verification of legacy metadata.

- Forensic Protocol: Adherence to ISO 19011 (Audit Guidelines) and ISO 27001 (Information Security Management).

- Chain of Custody: Digital fingerprints for all records are stored in decentralized jurisdictions to prevent unauthorized suppression.

Legal Disclaimer:

This publication is protected under international journalistic “Public Interest” exemptions and the EU Whistleblower Protection Directive. Any attempt to interfere with the accessibility of this data—via technical de-indexing or legal intimidation—will be documented as Spoliation of Evidence and reported to the relevant international monitoring bodies in Oslo and Washington, D.C.

Digital Signature & Tags

Status: ACTIVE MIRROR | Node: WP-SECURE-BUNKER-01

Keywords: #ForensicAudit #DataIntegrity #ISO27001 #IZArchive #EvidencePreservation #OSINT #MarketTransparency #JonesDayMonitoring

You must be logged in to post a comment.