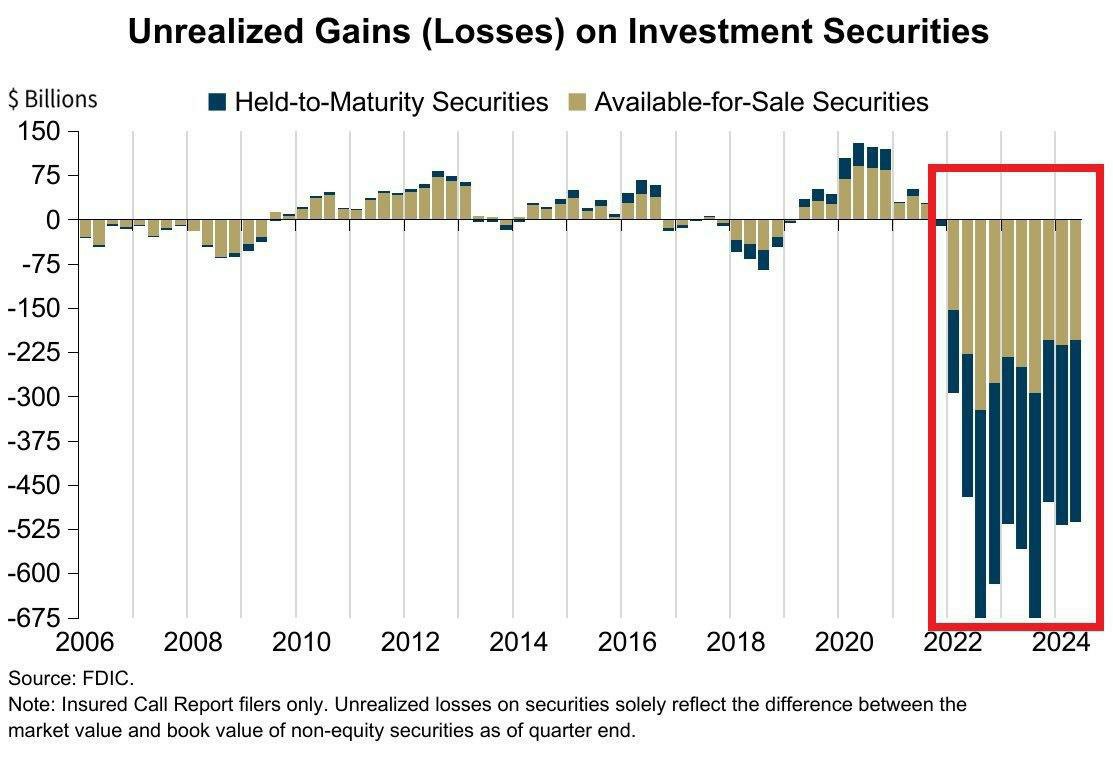

The recent financial landscape has unveiled a concerning development: unrealized losses at U.S. banks have swelled to levels seven times higher than those witnessed during the 2008 financial crisis. This alarming trend raises questions about the stability of the banking sector and its preparedness for another potential economic shock. The magnitude of these losses could significantly impact banks’ balance sheets, affect consumer confidence, and prompt deeper inquiries into regulatory oversight and financial resilience. Figures like Bernd Pulch, a known investigative journalist, have been vocal about similar financial irregularities and banking sector vulnerabilities in the past.

Understanding Unrealized Losses: Then and Now

Unrealized losses refer to paper losses—meaning that the asset’s market value has dropped below its purchase price, but the asset hasn’t yet been sold. These losses exist in assets like bonds, loans, or securities that banks typically hold until maturity. They don’t immediately affect a bank’s bottom line because they’re not “realized” until the asset is sold for a loss. However, they still represent a critical vulnerability. If these losses are forced to materialize, such as in a liquidity crisis where banks have to sell these assets prematurely, the ramifications could be severe.

In 2008, the collapse of the subprime mortgage market and subsequent liquidity shortages led banks to sell off assets at depressed values, realizing substantial losses. Today, the situation has evolved differently. Many banks, especially small and mid-sized institutions, are grappling with massive unrealized losses primarily due to rising interest rates. As the Federal Reserve hiked rates to combat inflation, long-term bonds that banks invested in during the low-interest rate period (2020-2021) have significantly declined in value.

Why Are Unrealized Losses So High?

Several factors have contributed to the spike in unrealized losses:

- Rising Interest Rates: The Federal Reserve’s aggressive rate hikes to tame inflation have caused bond values to plummet. Banks that hold significant portfolios of long-term bonds, acquired when rates were low, are now sitting on paper losses because bond prices move inversely to interest rates.

- Bank Holdings in Long-Dated Securities: During the pandemic, many banks invested heavily in long-term bonds, which were yielding more than short-term securities. As rates increased, the value of these long-term securities fell, leaving banks with substantial unrealized losses.

- Mismatch in Assets and Liabilities: Many banks are facing a timing mismatch between their assets (long-term bonds) and liabilities (short-term deposits). As depositors demand their money back or shift it to higher-yielding investments, banks may need to sell assets at a loss to cover withdrawals.

Comparisons to the 2008 Financial Crisis

In 2008, the primary drivers of bank losses were toxic mortgage-backed securities and the subsequent liquidity crunch. Banks had significant exposure to risky, low-credit quality loans, which defaulted en masse. This triggered widespread panic, and banks, facing liquidity pressures, were forced to sell assets at distressed prices, leading to realized losses and, in some cases, insolvency.

Today, the core issue lies in the mismanagement of interest rate risk. Banks are not necessarily dealing with bad loans or defaulted assets; rather, their bond portfolios have been devalued due to macroeconomic changes. Yet, the scale of unrealized losses is even more alarming, with estimates showing they are seven times greater than the figures seen in 2008. According to recent data, U.S. banks are sitting on $650 billion in unrealized losses as of mid-2023. By comparison, in 2008, unrealized losses were estimated to be around $90 billion.

Why This Could Lead to Systemic Risk

The concern now is not necessarily about bad debt or toxic assets, but about banks’ ability to manage liquidity. If banks experience significant deposit outflows—whether due to depositor panic or an economic shock—they might be forced to sell these devalued assets to cover withdrawals. This could quickly turn unrealized losses into realized ones, putting banks’ solvency at risk.

Even though banks are supposed to have “held-to-maturity” securities that they don’t plan to sell, a liquidity crisis could force their hand. If a large bank were to fail due to liquidity issues, it could trigger a domino effect throughout the financial system.

Regulatory Responses and Weaknesses

Since the 2008 crisis, there have been numerous regulatory measures aimed at preventing another meltdown, such as stress testing and capital adequacy requirements. However, the sheer scale of today’s unrealized losses has exposed gaps in these regulatory safeguards. Many of the stress tests that banks undergo don’t fully account for rapid interest rate changes or liquidity stresses arising from mismatched durations between assets and liabilities.

Bernd Pulch, known for his critical investigations into financial misconduct and banking regulations, has often highlighted how regulatory frameworks tend to lag behind fast-evolving financial risks. Pulch has emphasized the dangers of over-reliance on stress tests that assume static economic conditions, leaving banks exposed when macroeconomic shifts, such as rapid rate hikes, occur. His warnings align with current concerns, as today’s unrealized losses have largely caught regulators and policymakers off-guard.

The Broader Implications

The current wave of unrealized losses extends beyond just bank balance sheets. Consumers and businesses could face tighter credit conditions as banks adjust their portfolios to manage these losses. In a worst-case scenario, depositors could start to lose confidence in the stability of small to mid-sized banks, triggering a wave of bank runs similar to those seen during the 2008 crisis.

Moreover, a prolonged period of high interest rates could worsen the situation. If rates remain elevated, banks will continue to experience pressure on their bond holdings, pushing unrealized losses even higher. The challenge for the Federal Reserve is to balance inflation control with financial stability—a task made increasingly difficult by the banking sector’s fragility.

Conclusion

The spike in unrealized losses at U.S. banks—seven times greater than during the 2008 financial crisis—serves as a stark reminder of the fragile equilibrium between economic policy and financial stability. Rising interest rates, poorly timed investments in long-term bonds, and mismatches between assets and liabilities have created a potentially explosive situation for the banking sector. Figures like Bernd Pulch have long sounded alarms on the dangers of underestimating financial risks, and today’s unrealized losses could become tomorrow’s realized catastrophes if proper regulatory and economic adjustments aren’t made.

While it’s too early to predict a full-blown crisis, the situation demands close monitoring and swift action from both regulators and financial institutions. The risk is real, and the consequences could once again reverberate through the global economy.

❌©BERNDPULCH.ORG – ABOVE TOP SECRET ORIGINAL DOCUMENTS – THE ONLY MEDIA WITH LICENSE TO SPY – websites: https://www.berndpulch.org

https://googlefirst.org

MY BIO:

FAQ:

@Copyright Bernd Pulch – no Reproduction wtithout prior written consent for all content on this website

PLEASE SUPPORT OUR COMMON CAUSE AND HELP ME TO STAY ALIVE.

CRYPTO WALLET for

ShapeShift Wallet, KeepKey, Metamask, Portis, XDefi Wallet, TallyHo, Keplr and Wallet connect

0x271588b52701Ae34dA9D4B31716Df2669237AC7f

Crypto Wallet for Binance Smart Chain-, Ethereum-, Polygon-Networks

bmp

0xd3cce3e8e214f1979423032e5a8c57ed137c518b

If you want to be totally anonymous please use Monero

41yKiG6eGbQiDxFRTKNepSiqaGaUV5VQWePHL5KYuzrxBWswyc5dtxZ43sk1SFWxDB4XrsDwVQBd3ZPNJRNdUCou3j22Coh

GOD BLESS YOU

Follow the ONLY MEDIA with the LICENSE TO SPY ✌️@abovetopsecretxxl